Human Resources Best Practices

All about the Format of Salary Slip

The Mintly Team

October 18, 2023

A salary slip, also known as a payslip or paycheck stub, is a document that provides an employee with details about their salary and deductions. It serves as proof of income and contains crucial information regarding an employee’s earnings and deductions for a specific pay period. The format of a salary slip may vary across organizations, but it generally includes certain key components. In this blog post, we will explore the typical format of a salary slip and its importance.

Employee Information

-

- Employee Name: The name of the employee receiving the salary.

- Employee ID: A unique identification number assigned to each employee.

- Department: The department or division in which the employee works.

- Designation: The job title or position held by the employee.

Employer Information

-

- Company Name: The name of the employer or company issuing the salary slip.

- Company Address: The physical address or registered office address of the company.

- Contact Information: Contact details such as phone number, email address, etc.

Salary Details

-

- Pay Period: The specific time period for which the salary is being calculated.

- Date of Payment: The date on which the salary is being disbursed.

- Basic Salary: The fixed component of an employee’s salary before any deductions.

- Allowances: Additional amounts paid to employees, such as housing allowance, transport allowance, etc.

- Overtime Pay: If applicable, the amount for any extra hours worked beyond regular working hours.

- Bonus: Any additional payments or incentives provided to the employee.

- Deductions: Any deductions made from the employee’s salary, such as taxes, insurance premiums, loan repayments, etc.

Tax and Provident Fund Details

-

- Tax Deductions: The amount deducted as income tax from the employee’s salary.

- Provident Fund (PF) Contributions: The percentage of the employee’s salary contributed towards their retirement fund.

- Other Deductions: Any additional deductions like health insurance premiums, union fees, etc.

Net Salary

-

- Gross Salary: The total earnings of the employee before any deductions.

- Total Deductions: The sum of all deductions made from the gross salary.

- Net Salary: The amount payable to the employee after deducting all necessary taxes and other deductions.

The format of a salary slip may also include other information specific to an organization’s policies, such as leave balances, loan details, performance-related bonuses, etc. Some companies provide electronic salary slips, while others still use printed or physical copies.

Why is the format of a salary slip important?

The format of a salary slip is important for several reasons:

Clarity

A well-designed format ensures that all the information on the salary slip is presented in a clear and organized manner. This allows employees to easily understand their earnings, deductions, and any additional benefits they may be entitled to.

Transparency

A properly formatted salary slip provides transparency regarding the components that make up an employee’s salary. It clearly outlines the base salary, allowances, bonuses, and any deductions such as taxes or insurance premiums. This transparency helps build trust between the employer and employee.

Compliance

The format of a salary slip is often regulated by labor laws and tax regulations. By following the prescribed format, employers ensure compliance with legal requirements and avoid potential penalties or legal issues. The salary slip format may vary from one country to another, so it is important to adhere to the specific regulations of the jurisdiction.

Record keeping

A standardized format for salary slips facilitates effective record keeping. Employers can maintain a consistent record of employees’ earnings and deductions, which is essential for tax purposes, audits, and other financial reporting requirements. It also makes it easier for employees to keep track of their financial information and maintain their own records.

Verification

A well-designed salary slip format allows employees to verify the accuracy of their earnings and deductions. They can cross-check the amounts mentioned in the salary slip with their employment contract or previous payslips. This verification process helps identify any discrepancies or errors that need to be addressed promptly.

Financial planning

The format of a salary slip assists employees in planning their finances effectively. It provides them with a breakdown of their earnings, allowing them to understand how much they are earning and how much is being deducted. This information helps employees budget their expenses, set savings goals, and make informed financial decisions.

Loan applications

Many financial institutions require salary slips as supporting documents for loan applications. A properly formatted salary slip provides all the necessary details about an employee’s income, making it easier for them to apply for loans or credit facilities when needed.

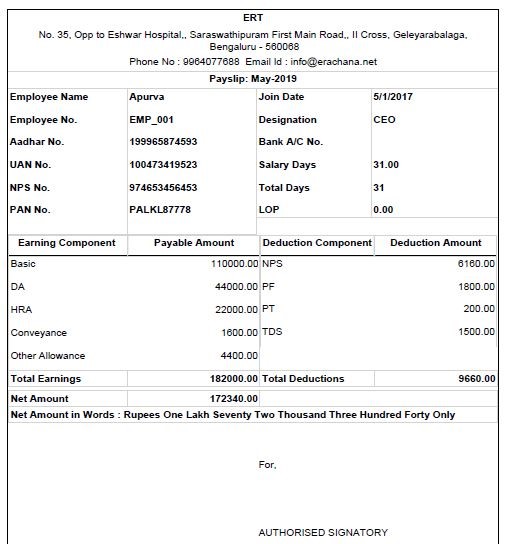

Salary Slip Format in India

- The format of salary slips followed in India typically includes the following details:

Employee Information:

-

- Employee name

- Employee ID or unique identification number

- Employee designation or job title

- Department or division

Company Information:

-

- Company name

- Company address

- Company contact details

Salary Details:

-

- Basic salary: The fixed component of the salary that is agreed upon between the employer and employee.

- Allowances: Various allowances such as HRA, travel, medical, etc.

- Deductions: Deductions may include income tax, provident fund (PF), professional tax, etc.

- Gross salary: The total salary amount before deductions.

- Net salary: The amount received by the employee after deductions.

Attendance and Leave Details:

-

- Number of days worked in the specified month.

- Number of days of leave taken.

- Leave balance details.

Tax Deductions:

-

- Income tax deducted at source (TDS) or tax deducted by the employer on behalf of the employee.

- Tax-related details such as PAN number, tax slab, etc.

Provident Fund (PF):

-

- PF contribution made by the employee.

- PF contribution made by the employer.

- PF account number.

Other Deductions and Reimbursements:

-

- Any other deductions such as loan repayment, insurance premiums, etc.

- Reimbursements for expenses such as travel, medical, etc.

Bank Account Details:

-

- Bank name

- Bank account number

- IFSC code

Earnings Summary:

-

- Detailed breakup of various earnings components such as basic salary, allowances, overtime pay, etc.

Summary of Deductions:

-

- Detailed breakup of various deduction components such as income tax, PF contribution, loan repayment, etc.

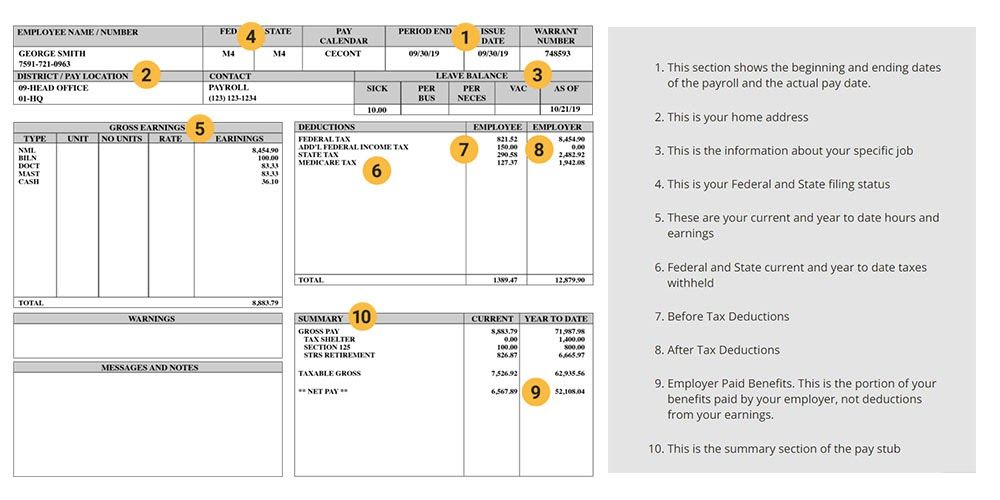

Format of Salary Slip in US

In the United States, a salary slip, also known as a pay stub or paycheck stub, is a document provided by employers to their employees to outline the details of their salary payment. The format of a salary slip in the US typically includes the following information:

Employee Information:

The salary slip begins with the employee’s basic information, such as their name, employee ID or social security number, and contact details.

Employer Information:

This section includes the name, address, and contact information of the employer or company.

Pay Period:

The salary slip specifies the pay period for which the payment is being made. It usually includes the start and end dates of the pay period.

Earnings:

This section provides a breakdown of the employee’s earnings for the pay period. It includes details such as the regular hourly or salaried rate, number of hours worked (if applicable), overtime hours (if any), and any additional allowances or bonuses.

Deductions:

The deductions section lists various deductions from the employee’s gross earnings. This may include federal and state taxes, social security and Medicare contributions, health insurance premiums, retirement contributions, and any other authorized deductions.

Net Pay:

The net pay is the final amount that the employee receives after deducting all applicable taxes and deductions from their gross earnings.

Year-to-Date (YTD) Summary:

The salary slip often includes a year-to-date summary of earnings and deductions. It provides a cumulative total of the employee’s earnings and deductions since the beginning of the calendar year.

Additional Information:

Some salary slips may also include additional information, such as vacation or sick leave balances, loan repayments, or any other relevant details specific to the employee’s employment agreement.

Payment Method:

The salary slip typically indicates the method of payment, whether it is through direct deposit, physical check, or any other designated payment method.

Employer Signature:

The salary slip is usually signed by an authorized representative of the employer to certify its accuracy.

It is important to note that the format of salary slips may vary slightly between different employers or states in the US. However, the basic components mentioned above are commonly included to ensure transparency and provide employees with a clear understanding of their earnings and deductions.

What if I don’t have Salary Slip?

If you don’t have a salary slip, there are a few alternative options you can consider to provide proof of income or employment:

- Bank statements: You can provide your bank statements that show regular deposits from your employer as evidence of your income.

- Employment contract: Your employment contract can serve as proof of your employment status and the terms agreed upon.

- Offer letter: If you recently started a new job and haven’t received a salary slip yet, you can provide your offer letter as proof of your employment.

- Income tax returns: Your income tax returns can be used to demonstrate your income over a specific period. This can be helpful if you are self-employed or receive income from multiple sources.

- Reference letter: A reference letter from your employer or supervisor can verify your employment and income details.

People working in Industries like Jewelry Jobs, Mining Jobs in countries such as India, Cambodia, Thailand might not get salary slips. In this digital world, many companies are still paying cash to the employees or workers. You can request your employer to issue Salary Slip when you are exiting the company.

Final Thoughts

In conclusion, the format of a salary slip plays a vital role in providing employees with a clear breakdown of their earnings and deductions. It ensures transparency, legal compliance, and acts as proof of income. Understanding the format of a salary slip is essential for both employers and employees to maintain effective communication and meet financial obligations.

Remember to consult your organization’s policies or local labor laws for specific requirements regarding the format of a salary slip.

All Tags

Loading...

Loading...