Demand Forecasting Tools in Precious Metals Industry

Veejay Ssudhan

July 21, 2024The precious metals industry, encompassing gold, silver, platinum, and palladium, is a cornerstone of global financial markets, jewelry, electronics, and industrial applications. Accurate demand forecasting is crucial for stakeholders in this sector to make informed decisions, manage risks, and optimize their operations. This blog delves into various tools used for demand forecasting in the precious metals industry.

Understanding Demand Forecasting

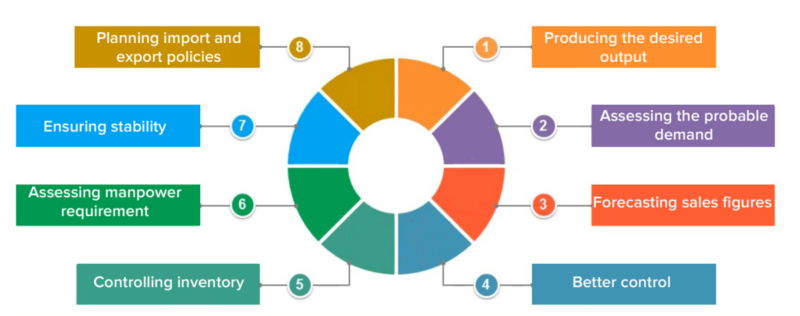

Demand forecasting is the process of predicting future customer demand for products or services based on historical data, market trends, and various analytical techniques. Accurate demand forecasting is crucial for businesses as it helps in making informed decisions regarding inventory management, production planning, and resource allocation.

There are several methods of demand forecasting, including qualitative approaches like expert opinion and market research, and quantitative methods such as time series analysis and econometric models. Each method has its advantages and is chosen based on the specific context and available data.

Effective demand forecasting can lead to reduced costs by minimizing excess inventory and avoiding stockouts. It also enables companies to better respond to market changes and customer needs. However, it is essential to continuously monitor and update forecasts as new data becomes available to maintain accuracy.

By understanding demand forecasting, businesses can optimize their operations, improve customer satisfaction, and gain a competitive edge in the market.

Key Tools for Demand Forecasting

1. Time Series Analysis

Time series analysis is a statistical technique that uses historical data to predict future values. It is one of the most widely used methods for demand forecasting in the precious metals industry.

a. Moving Averages

Moving averages smooth out fluctuations in historical data to identify trends and patterns.

Simple Moving Average (SMA)=1N∑i=1NXi\text{Simple Moving Average (SMA)} = \frac{1}{N}\sum_{i=1}^{N} X_i

where (N) is the number of periods and (X_i) are the values over those periods.

b. Exponential Smoothing

Exponential smoothing assigns exponentially decreasing weights to past observations.

St=αXt+(1−α)St−1S_t = \alpha X_t + (1 – \alpha) S_{t-1}

where ( \alpha ) is the smoothing constant.

2. Econometric Models

Econometric models use economic theories and statistical methods to forecast demand by analyzing relationships between different variables.

a. Regression Analysis

Regression analysis measures the relationship between a dependent variable (e.g., precious metal demand) and one or more independent variables (e.g., price, interest rates).

Y=β0+β1X1+β2X2+…+βnXn+ϵY = \beta_0 + \beta_1 X_1 + \beta_2 X_2 + … + \beta_n X_n + \epsilon

where ( Y ) is the dependent variable, ( X_1, X_2, …, X_n ) are independent variables, ( \beta_0 ) is the intercept, ( \beta_1, \beta_2, …, \beta_n ) are coefficients, and ( \epsilon ) is the error term.

3. Machine Learning Algorithms

Machine learning algorithms can handle large datasets and capture complex patterns that traditional statistical methods might miss.

a. Neural Networks

Neural networks consist of interconnected layers that process data in a way similar to the human brain.

y=f(∑i=1nwixi+b)y = f\left( \sum_{i=1}^{n} w_i x_i + b \right)

where ( y ) is the output, ( f ) is the activation function, ( w_i ) are weights, ( x_i ) are inputs, and ( b ) is the bias.

b. Support Vector Machines (SVM)

SVMs find the hyperplane that maximizes the margin between different classes in the dataset.

f(x)=wTx+bf(x) = w^T x + b

where ( w ) is the weight vector and ( b ) is the bias.

4. Artificial Intelligence (AI) and Deep Learning

AI and deep learning models can analyze vast amounts of data to identify trends and make accurate predictions.

a. Recurrent Neural Networks (RNN)

RNNs are designed for sequential data and can capture temporal dependencies.

ht=f(Whht−1+Wxxt+b)h_t = f(W_h h_{t-1} + W_x x_t + b)

where ( h_t ) is the hidden state at time ( t ), ( W_h ) and ( W_x ) are weight matrices, ( x_t ) is the input at time ( t ), and ( b ) is the bias.

b. Long Short-Term Memory (LSTM)

LSTMs are a type of RNN that can remember long-term dependencies.

ct=f(ct−1,it,ft,ot)c_t = f(c_{t-1}, i_t, f_t, o_t)

where ( c_t ) is the cell state at time ( t ), and ( i_t, f_t, o_t ) are input, forget, and output gates respectively.

5. Big Data Analytics

Big data analytics involves processing large volumes of data to uncover hidden patterns and insights.

a. Hadoop

Hadoop is an open-source framework that enables distributed processing of large datasets across clusters of computers.

b. Apache Spark

Spark is a unified analytics engine for big data processing with built-in modules for streaming, SQL, machine learning, and graph processing.

6. Business Intelligence (BI) Tools

BI tools provide interactive data visualization and reporting capabilities to help stakeholders make informed decisions.

a. Tableau

Tableau offers powerful data visualization features that allow users to create interactive dashboards.

b. Microsoft Power BI

Power BI integrates with various data sources to provide real-time insights through interactive reports and dashboards.

7. Simulation Models

Simulation models use mathematical algorithms to mimic real-world processes and predict future outcomes.

a. Monte Carlo Simulations

Monte Carlo simulations use random sampling to estimate the probability distribution of potential outcomes.

E(X)=1N∑i=1NXiE(X) = \frac{1}{N}\sum_{i=1}^{N} X_i

where ( E(X) ) is the expected value and ( N ) is the number of simulations.

8. Cloud-Based Platforms

Cloud-based platforms offer scalable computing power and storage to handle large datasets and complex calculations.

a. AWS Forecast

AWS Forecast uses machine learning to generate accurate forecasts based on historical data.

b. Google Cloud AI Platform

Google Cloud AI Platform provides tools for building, training, and deploying machine learning models in the cloud.

Case Study: Forecasting Gold Demand Using Machine Learning

To illustrate how these tools can be applied in practice, let’s consider a case study on forecasting gold demand using machine learning.

Data Collection

Data on historical gold prices, global economic indicators (e.g., GDP growth rates, inflation rates), and other relevant factors (e.g., geopolitical events) are collected. These come from various sources such as financial databases, government reports, and news articles.

Data Preprocessing

The collected data is cleaned to remove any inconsistencies or missing values. Feature engineering techniques are used to create new variables that capture essential patterns in the data.

Model Selection

Various machine learning algorithms such as neural networks, support vector machines, and random forests are evaluated based on their performance metrics such as mean absolute error (MAE), root mean squared error (RMSE), and R-squared (( R^2 )) value.

Model Training

The selected model is trained on historical data using techniques such as cross-validation to ensure its robustness and generalizability.

Model Evaluation

The model’s performance is evaluated on a test dataset to assess its accuracy in predicting future gold demand.

Deployment

You can deploy the trainable model in a production environment. It can continuously receives new data inputs and generates updated forecasts. These can be useful for stakeholders for decision-making purposes.

Using Demand Forecasting tools, can indirectly help in improving Business Productivity. Every precious metals businesses must leverage use of analytic and forecasting tools to scale up the profit.

Conclusion

Accurate demand forecasting in the precious metals industry requires a combination of statistical methods, machine learning algorithms, big data analytics tools, business intelligence platforms, simulation models, and cloud-based solutions. By leveraging these tools effectively, companies can gain valuable insights into market trends, optimize their operations, manage risks more efficiently, and ultimately drive growth and profitability in this dynamic sector.

All Tags

Loading...

Loading...