Learning Courses, Certifications, Processes

What will be the future of KYC?

Shreya Matta

September 16, 2022“Know your customer”, full form of KYC, processes in finance used to be a pen and paper thing, with a lot (and we mean a lot) of photocopies of driver’s licenses. New technologies are now available to replace manual labor with fully digitized workflows. But current discussions around KYC online focusing on the balance of compliance requirements and user experience only scratch the surface. There’s a lot more to be said about the future of KYC and planning for success starts now.

What is KYC?

KYC is a mandatory verification process for banks, lenders, insurance providers, and other financial and monetary companies of all sizes. By law, organizations follow process to identify customers. Gathering background information on the customers and assessing the risk factors is important. KYC is the data-driven process allowing companies to ensure that their customers:

- are who they claim to be

- meet the requirements to use regulated financial services

- don’t engage in criminal activities using their products

- the goal is to prevent fraud, tax evasion, terrorism financing, and other financial crimes.

With a proper understanding of customers and their financial dealings, service providers can reject applicants with questionable or shady profiles. From there, they can more easily monitor their clients’ activities and manage risk. As they say: knowledge (about your customers) is power.

Why it matters for bankers, lenders, and insurers that the compliance regulations governing KYC are complex and layered?

Generally speaking, KYC or know your customer is rooted in Anti-Money Laundering (AML) standards and legislation — which exist both at global and national levels.

In 1989, countries around the world made a concerted effort to fight financial crime by committing to follow the recommendations of the Financial Action Task Force. But KYC doesn’t have a single, one size fits the definition. Different geographies have different versions of KYC AML legislation, and other laws might also factor in, too.

In the current compliance environment, regulated institutions have to build their own KYC program. They will craft internal policies based on their interpretation of the applicable regulations and understanding of the risks they are facing. These policies dictate the instances where KYC is required and the kind of information they need to perform verifications.

Standard KYC registration online procedures generally start when a business onboards a new client, or when a current client acquires a regulated product. They fall along these lines:

Customer identification program (CIP) — Customer is who they say they are.

Financial businesses have to collect reliable information to verify their customers’ identity — you know, making sure they’re real people. The customer provides an ID and proof of address and other documents as required. The business must then countercheck that information using documents, non-documentary methods, or a combination of both. A positive match indicates that the customer is who they say they are.

Customer due diligence (CDD) — Risk

Financial providers must be especially careful about who they take in as clients. As a result, they conduct detailed risk assessments with extensive background checks. Here, they have more leeway in how they go about fulfilling their due diligence responsibilities. They might require customers to provide information about their occupation, the purpose of their account, and the source of their funds, all the way to financial statements, banking references, and other documents. As a result of their analysis, they assign a risk rating to each client and monitor their activities accordingly.

Ongoing monitoring — Data

Financial institutions must monitor their clients’ transaction patterns, especially those with high-security status, and report suspicious activities. Widespread KYC compliance not only protects individual clients from the impacts of fraud. It protects the integrity of the financial system by reducing the odds of businesses being used for criminal activities.

A framework to think about KYC

An effective KYC compliance program is mandatory to fulfill anti-money laundering obligations, which means that failing to meet the requirements can lead to hefty fines or even criminal prosecution. But there is more depth to it than a simple exercise in compliance.

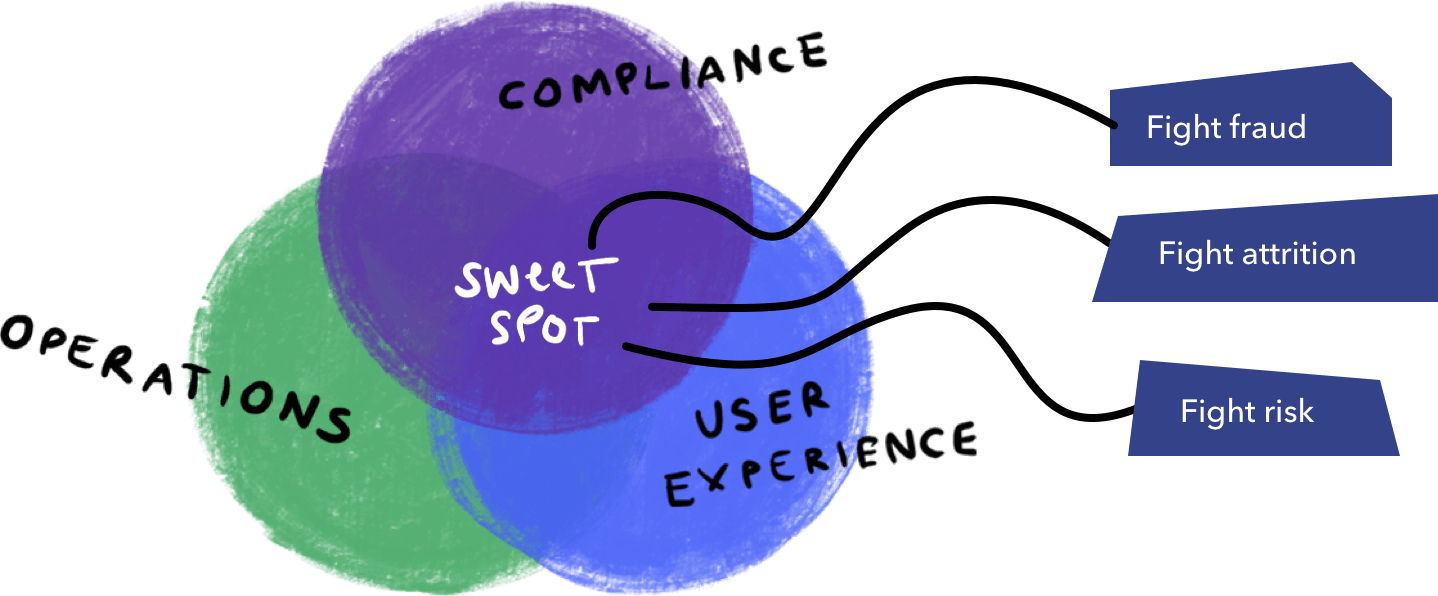

It actually performs 3 core functions within any financial business as stated below. Understanding how KYC works and impacts your business on all three levels allows you to optimize opportunities to fight fraud, customer attrition, and business risks.

KYC Compliance

KYC requirements were raised to the forefront of financial crime prevention in the 1990s. While they helped organize the fight against money laundering, they also lacked nuance. Meeting regulatory expectations back then meant having the right controls in place, and was mostly about ticking all the right boxes.

The baseline for KYC has since evolved. Regulators and businesses have now embraced the risk-based approach. RBA is the current compliance environment that we outlined in the previous section, in which business-specific risks are identified and managed.

Financial institutions must assess their vulnerability to fraud based on the type of products they offer as well as their political and economic context. They develop their own policies and deploy controls that match the actual risk they’re facing. The extent of due diligence and monitoring for a particular customer is tied to their risk rating.

User Experience

KYC is an integral part of your customer onboarding process. Asking customers to manually enter information and provide documents has a special way of complicating things. Those are the kind of actions that add friction to their experience.

Optimal onboarding journeys offer more than one path to success and allow users to switch seamlessly, if and when they want to.

Yet in practice, financial providers are often the ones disrupting the process, whether by asking their applicants to leave their experience to gather more documents or by waiting for an in-person meeting.

Financial businesses also struggle to offer alternatives when the most common method of identity verification — in-person verification — fails to work or can’t be applied. This leaves applicants with no choice but to drop the onboarding process.

Operations

The rules of regulatory compliance and the rules of business are not as contradictory as they may seem at first. A sound KYC program actually protects your company from potential risks to business operations.

For one, financial providers with inadequate verification processes are subject to greater risks of fraud, with monetary and reputational implications. Efficient KYC processes delivers competitive advantage as financial firms have the expectations to deliver consumer trust on top of great user experiences.

The cost of running a KYC program is trending up for both front- and back-office operations. Complicated and ever-changing regulations mean that your KYC policies and processes have to be kept up-to-date. Outdated data collection methods force businesses to rely on inefficient manual labor to sort through KYC applications. Improving the cost-effectiveness of KYC processes has become a key challenge in recent years.

The state of KYC

There is no single standard for KYC in an industry ranging from personal financial management startups to centuries-old financial institutions. There is, however, a common theme. As a data-driven process, with KYC you can see big improvements using Technology.

In the banking and financial sector, checks happens through a mix of analog and digital channels. Financial firms with a long history of KYC AML compliance likely to have in-person, paper-based processes using automation by digital touchpoints.

They’ve made sizable investments and their processes are proven to work — at least when it comes to meeting their KYC policies goals. But disconnections, in the form of channel switching and having to share the same information repeatedly, cripple the customers’ experience.

On top of this, having to keep up with ever-changing KYC regulations poses a real challenge to every financial provider.

The evolving status quo of KYC compliance

The current status of KYC compliance is one characterized by Crucial transitions in all its aspects.

Firstly, this transition is part of the overall digital transformation in the financial services trend that has been dominating the industry for quite some time.

According to a study on the State of Digital Transformation in Financial Services published by Forrester in February 2021, 40% of surveyed FS firms were undergoing a digital transformation process before the COVID-19 crisis. The same study reveals that 19% of surveyed firms were still “investigating how to execute digital transformation” but had not yet begun.

However, as financial institutions and regulated organizations review their internal structures to equip their businesses for the challenges of the future, they must avoid falling into this trap.

The trends that we have explored in the previous chapter – recently accelerated by the COVID-19 pandemic – are changing KYC compliance as we know it.

Customer friction is increasing

Customers open accounts and sign up for new products as a means to reach their goals — buy a house, send or receive payments, put money away for retirement, and so much more. Yet to get there, they must jump through an ever-increasing amount of hoops. Here, the experience of corporate clients serves as a baseline for how exhausting this process can feel.

Onboarding new corporate clients now take banks weeks on average, and that number keeps on rising according to Thomson Reuters. That waiting period is expensive for both financial firms and their clients. A survey by Thomson Reuters shows that 89% of companies did not have a good KYC experience, and 13% had changed banks as a result.

In addition to the time spent gathering their information and documents, ongoing monitoring adds its own layer of friction. Customers don’t appreciate having their transactions blocked or being requested to provide more documents and end up finding the process unnecessarily invasive and time-consuming.

Compliance costs are increasing

Regulatory compliance is becoming more and more of a challenge, both in terms of complexity and costs. Staying up to date with global and local anti-money laundering legislation can be a burden, and only intensifies as businesses cross borders to expand their activities.

In the current state of practices, customer due diligence and ongoing monitoring weigh heavily on business operations. To keep up with the workload, financial institutions have been hiring a staggering number of risk professionals, driving up the cost of KYC procedures. Globally, financial firms’ average costs to meet their obligations are $60 million, with major financial institutions spending up to $500 million annually.

KYC as it should be

It’s now somewhat of a truism that customers expect from their financial providers the same high-quality digital experiences they get from Amazon or Uber. A positive experience is indeed an important differentiator in an increasingly competitive landscape.

Data suggest that the onboarding experience is a key factor that makes or breaks the client relationship. As a result, conversations around KYC usually get lost in the details about balancing UX and compliance. But given the current state of technology, that’s an either/or trap: improving one doesn’t come at the cost of the other anymore.

For innovative companies working to reach the sweet spot of compliance, UX, and operations, smart and agile KYC technologies have moved from ‘nice to have to ‘must have’. Digitizing your process gives you the ability to integrate identity verification seamlessly into your onboarding experience. Providing multiple options allows your customers to engage in the manner they prefer.

Leveraging multiple data sources leads to higher match rates and data quality, allowing you to fulfill your due diligence obligations more efficiently. The challenge now lies in choosing the right technology and putting it to work.

The Future of KYC

Embracing the digital transformation of the KYC process allows financial businesses to reduce operational costs, be more responsive to customers’ needs and strengthen their processes. The future of KYC is in stark contrast with today’s labor-intensive and time-consuming processes.

Why KYC is Important?

With minimal input from customers, innovative financial businesses will leverage multiple sources to validate the data provided by the customers and generate faster, more accurate decisions. The adoption of financial data connectivity is currently on the rise across the globe. The benefits are widespread, with immediate and future improvements to compliance operations, risk management, customer experience, and even marketing.

Simplify compliance.

Financial data connectivity allows you to instantly collect personal and income information in a format that conveniently fits with your compliance procedures.

Automate your processes.

The data from your customers’ accounts can be verified by a program to automate routine tasks, such as high-level risk assessment, leading to quick approval of low-risk clients. You can assign cases requiring manual review to the right professionals, based on the outcome of the analysis.

- Digital-first Customer-centric

- Powered by scalable automation

- On-going and on-demand

Build to scale.

Financial data connectivity provides a very wide reach, as most customers have an online banking account from which you can gather data. This means you can expand your business to new geographies without entirely rebuilding your processes.

Pave the way for your customers. Pulling banking data early in your onboarding process allows you to pre-fill forms that your customers only have to verify. This makes the procedural parts smooth and forgettable and lets your customers focus their attention on the benefits of your product.

It’s time to really know your customers.

Offering amazing digital experiences is about empathizing with your customers to understand their needs and frustrations. Killing friction in your onboarding process is just a start. The information you gather can — and should — be used to provide personalized, practical solutions helping your clients move from aspiration to action.

Digital KYC

A digital KYC process leveraging financial data allows you to start your client relationship on the right foot. With the same connection powering your KYC process, your customers can authorize you to collect their transaction history. Once properly cleaned and categorized, transactional data can feed your models. What you get are deep insights allowing you to understand their needs, anticipate their next steps and personalize their experience throughout their journey.

The elements of a successful digital KYC implementation

A digitization project is an extremely unique opportunity to introduce solutions and procedures. Those that will shape the way staff work on a day-to-day basis for a long time. Such a perspective – however daunting – can help fully appreciate why all digital transformation journeys . Even if its complex, extended – should embrace the concept of agility.

This term in the software development community describes a very specific way of writing code and building products that can be applied to many more aspects of digital transformation in financial services compliance. In the space of digital KYC, it translates as follows:

Agile planning

Plan for change in all its aspects by setting out a roadmap that you can adjust as you learn more about your customers’ preferences or your team’s needs. You can adjust according to regulatory requirements of new jurisdictions you want to grow your business. But make sure different departments get involved by bringing to the table their own expertise in regulatory compliance, risk, UX/UI, Customer Support, or IT.

Agile technology

You can apply the term agility to many more aspects of digital transformation in financial services compliance.

Partnering with a third party you can choose flexible digital solutions. The solutions can configured based on your specific needs and internal processes and changed over time;

Agile regulatory set-up

Make sure that your new systems and procedures are fully compliant with the regulations of today. It can also be adaptable to the regulations of tomorrow. Or even the regulations of another jurisdiction your business will be growing in.

Agile scope

Rome wasn’t built in a day, and full digital transformation never happened overnight. You start from a pressing problem while keeping in mind the big picture. This will help you achieve tangible goals on the way to long-lasting change.

KYC is an exciting field to get into for HR back office roles. Many organizations with large employees have KYC teams to help them with Onboarding process. There is constant posting for KYC jobs in various portals for hiring round the clock.

Conclusion

The future of KYC (Know Your Customer) holds promising advancements driven by technology. There is a rise of artificial intelligence, blockchain, and biometrics. KYC processes will become more streamline, efficient, and secure. Enhanced automation, real-time verification, and global standardization will reshape the future of KYC, ensuring greater compliance and customer convenience.

All Tags

Loading...

Loading...

![What is Know Your Customer (KYC)? [Complete Guide]](https://www.blog1.trymintly.com/wp-content/uploads/2022/09/Add-a-heading.png)