The Pros and Cons of Investing in Gold and Platinum

The Mintly Team

April 11, 2023Investing in gold and platinum can be an excellent way for people to diversify their portfolios. Both gold and platinum have been considered valuable assets for centuries, with their prices often moving in different directions from traditional investments like stocks and bonds. This guide give you the pros and cons of investing in both gold and platinum. This can help potential investors decide which asset is better suited to their individual needs.

Understanding the Basics of Investing in Precious Metals

If you’re looking to diversify your investment portfolio, investing in precious metals like gold and silver can be a great option. Not only are these metals tangible assets that hold their value over time, but they also tend to perform well during times of economic uncertainty. However, before diving into the world of precious metal investing, it’s important to understand some basics.

Firstly, there are different ways to invest in precious metals. You can buy physical gold or silver bullion coins or bars and store them yourself, or you can invest in exchange-traded funds (ETFs) that track the prices of these metals. Additionally, it’s crucial to research reputable dealers before making any purchases as there are many fraudulent sellers out there.

Another key aspect of precious metal investing is understanding market trends and factors that influence prices. Factors like global economic conditions and political instability can greatly affect the value of gold and silver.

Investing in Platinum

Platinum is one of the rarest and most valuable precious metals in the world, with a wide variety of industrial applications. Investing in platinum can offer several benefits, including protection against inflation and currency devaluation.

Before investing in platinum or any other precious metal, it’s essential to understand the basics of how these investments work. Firstly, it’s important to decide on the form in which you want to invest – whether physical bullion or through an exchange-traded fund (ETF). Physical bullion involves purchasing bars or coins directly from a dealer while ETFs allow you to buy shares in a fund that holds physical metal reserves.

The Pros of Investing in Gold and Platinum

Investing in precious metals like gold and platinum has been a popular option for investors around the world. These two metals have become increasingly attractive due to their ability to act as a hedge against inflation and economic turmoil. Gold is considered the most popular investment choice among the two, as it has been used as currency for centuries. However, platinum is not far behind when it comes to investment opportunities. In fact, some investors believe that platinum may surpass gold in terms of value.

One of the main advantages of investing in gold and platinum is their rarity. Both these metals are found only in limited quantities across the globe. This scarcity factor makes them valuable and less susceptible to fluctuations based on demand and supply factors. Unlike other investments such as stocks, bonds or real estate, precious metals are tangible assets that can be held physically or through certificates of ownership.

The Cons of Investing in Gold and Platinum

When it comes to investing in precious metals, gold and platinum are two of the most popular choices. While these metals have been considered a safe investment for centuries, there are some downsides that investors need to be aware of before diving in.

Firstly, investing in gold and platinum can be quite expensive due to their high market value. This means that only high net worth individuals or institutional investors may have enough capital to invest in significant amounts. Additionally, both metals require secure storage facilities which can also add extra costs to the investment process.

Secondly, the value of gold and platinum is heavily influenced by global economic conditions and geopolitical events. This makes them highly volatile investments that can experience sudden price fluctuations without warning. Moreover, there is no guarantee that their value will increase over time which could lead to losses for investors who fail to sell at the right time.

Market Trends and Historical Performance

Investing in precious metals has always been a popular choice for investors as they are considered a safe haven investment. However, with the recent market trends and historical performance, it is important to consider how much one should invest in precious metals. It is crucial to note that investing too much or too little can cause financial losses.

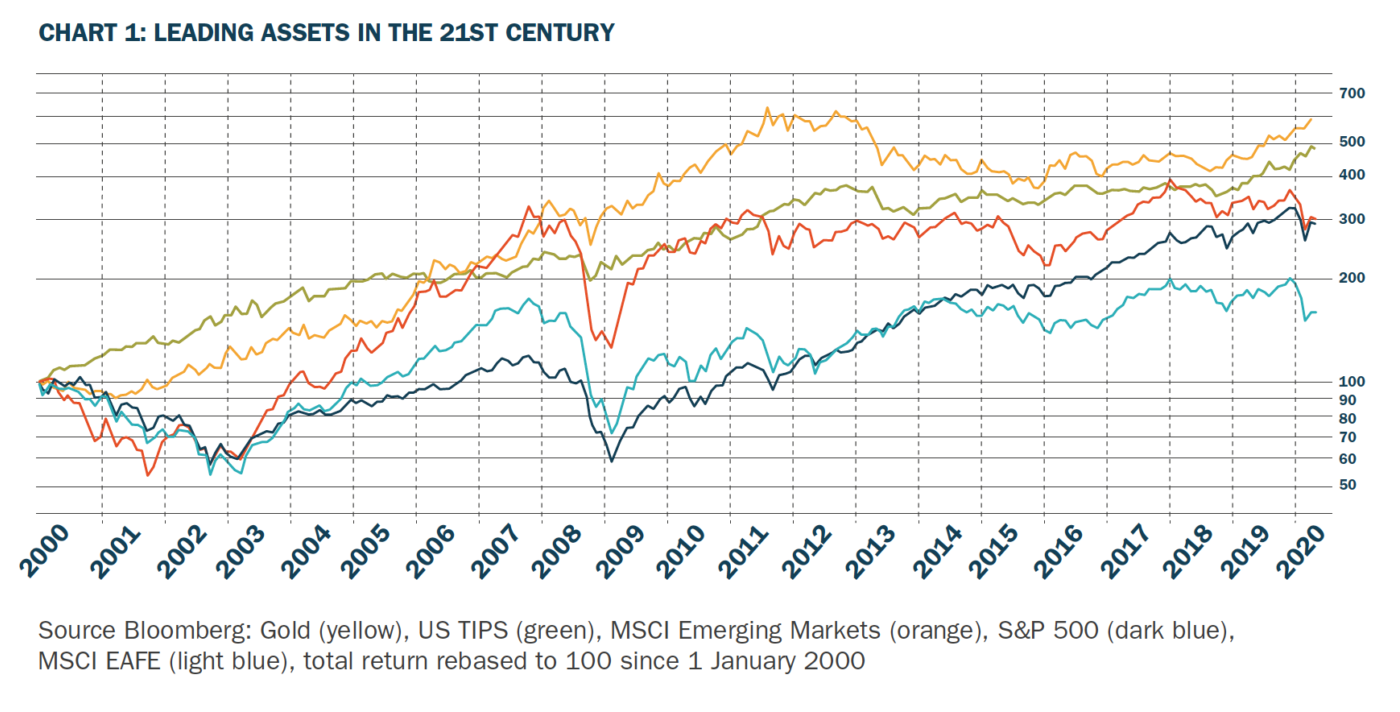

Historically, precious metals like gold and silver have shown positive returns over time. In fact, gold has outperformed stocks and bonds during times of economic uncertainty such as the 2008 financial crisis. This makes it an attractive option for investors looking to diversify their portfolio. However, it is important to remember that past performance does not guarantee future results.

Market trends also play a significant role in determining how much one should invest in precious metals. Gold and platinum have both been used as forms of currency and valuable commodities for centuries, and their value has fluctuated over time. In recent years, both metals have seen significant price increases, with gold reaching all-time highs in 2020. However, it’s important to note that past performance is not a guarantee of future success, and investors should carefully consider market trends and other factors before making any investment decisions.

Gold and Platinum Investments

Gold and platinum have both been considered safe-haven investments during times of economic uncertainty, as their value tends to increase when other investments, such as stocks, are performing poorly. In recent years, gold has seen a significant increase in demand due to global economic and political instability, as well as the post COVID-19 pandemic.

Platinum, on the other hand, has seen a decrease in demand due to a decline in the automotive industry, which is one of the largest consumers of the metal. However, platinum is still considered a valuable investment due to its rarity and use in various industries, such as jewelry and electronics. As with any investment, it’s important to carefully consider market trends and other factors before making a decision to invest in gold or platinum.

Investing in Gold and Platinum

Investing in precious metals like gold and platinum can be an excellent way to diversify your investment portfolio. These metals have a long history of retaining their value, making them a safe haven for investors during times of economic uncertainty. Whether you’re new to investing or looking to expand your existing portfolio, here’s how you can start investing in gold and platinum.

Firstly, determine the amount of money you would like to invest in these metals. You can buy physical bullion coins or bars from reputable dealers or invest through exchange-traded funds (ETFs) that track the price of gold and platinum. ETFs are often preferable for those who don’t want the hassle of storing physical metal as they offer a convenient way to gain exposure to these precious metals without having to hold onto them directly.

Secondly, research the market conditions before making any investment decisions.

Investing in Rare Metals

Investing in rare metals can be a lucrative decision for investors who are interested in diversifying their portfolio. Rare metals, such as those found in the Earth’s crust and elsewhere, hold great value. This is because of their scarcity and unique properties that make them indispensable in various industries. These metals have high demand due to their rarity, which makes them ideal for long-term investments.

To invest in rare metals, an investor must first research the market thoroughly. They need to gain an understanding of supply and demand dynamics. It is essential to know which rare metal is currently experiencing high demand from buyers . This can turn a profit on your investment. One of the most popular ways to invest in rare metals is through exchange-traded funds (ETFs). An ETF allows investors to buy shares that track prices of specific rare metals without having to physically own them.

Buying Precious Metals From Fidelity

Investors looking for a safe haven to park their assets often turn to precious metals. Buying precious metals from Fidelity can be an excellent option. The company offers a wide range of gold, silver, platinum, and palladium products that can cater to any investor’s needs. Fidelity offers the right tools to invest in Gold and Platinum

Fidelity has been in the investment game for over 70 years and is known for its high-quality products and services. The company’s precious metal offerings include bullion bars and coins . Most of them come from the world’s reputable mints such as the US, Royal Canadian, Perth, and more. Fidelity also offers IRA-approved precious metals that can be used to diversify your retirement portfolio.

Another reason why buying precious metals from Fidelity makes sense is because of their competitive pricing. The company provides transparent pricing on all its products without any hidden fees or markups.

USAA Precious Metals and Minerals Fund are two of the funds managed by Fidelity.

IRAs are subject to federal laws and restrictions governing their investments in precious metals. The only precious metals permitted to be purchased in a Fidelity IRA are: Gold American Eagle . They come in (1 oz, 1/2 oz, 1/4 oz, and 1/ 10 oz) Gold American Buffalo (1 oz).

When trading precious metals, Fidelity acts as an agent only. They hold no inventory in precious metals, nor does Fidelity buy or sell by taking positions in the market.

Final Thoughts

In conclusion, investing in gold and platinum can be a lucrative venture. But it is important to consider the factors associated with each option. Gold may offer more stability than platinum, but its price may lack potential for growth. On the other hand, platinum may be more volatile and expensive, yet it could also offer greater returns over time. Ultimately, an investor must weigh the pros and cons of both investments before making a decision.

All Tags

Loading...

Loading...