Trading Gold on Forex to Diversify Portfolio: 5 Tips

The Mintly Team

November 06, 2023

For a balanced portfolio, you can’t stick with only stocks and bonds if you want your transactions to be stable amidst fluctuating financial markets. You’ll need to consider additional assets—and gold is a very lucrative one. There are many methods you can use to transact with it. You can buy gold bars and tokens. You can invest in digital gold, which combines the value and stability of the asset with the convenience and accessibility of technology. However, consider trading gold on forex if you want to get high-yield returns.

This allows you to combine the volatility and profitability of the foreign exchange market with gold’s steadfastness, creating significant opportunities for gains. Here are five tips you can try to do just that.

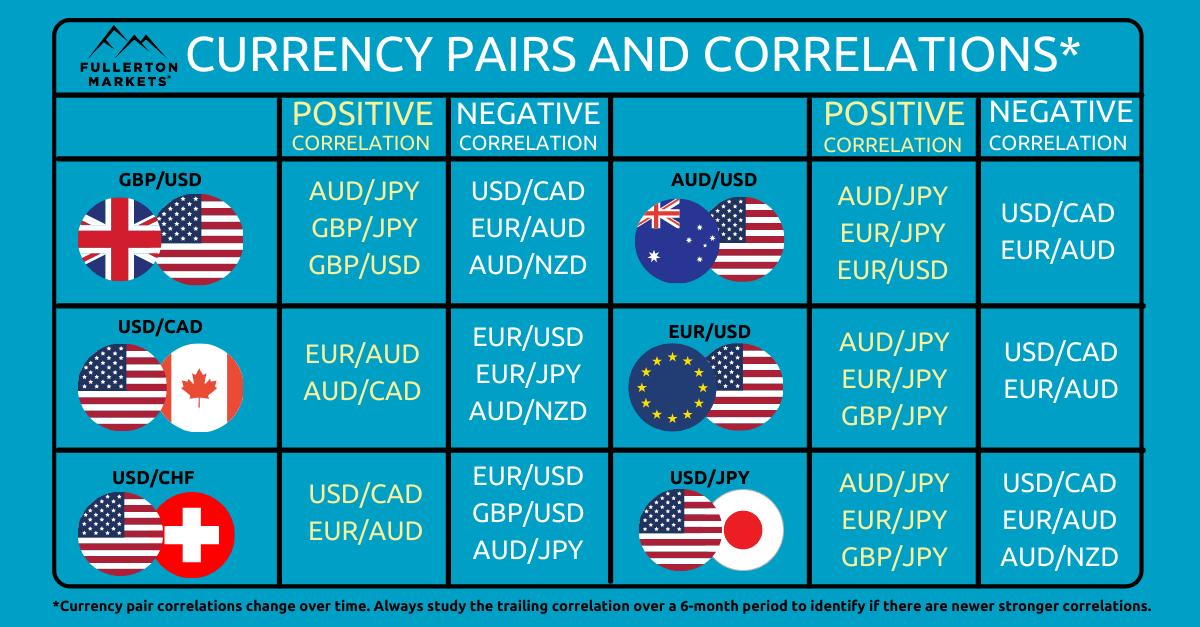

Choose currency pairs based on their gold correlation

Deciding to trade gold on forex means you now have a clear guide on choosing your currency pairs. You’ll want to note that each currency correlates with gold. Some, like AUD, GBP, and JPY, have positive correlations—when gold prices rise, so does the value of these currencies. Some currencies have negative correlations with gold, the most famous of which is the USD. Knowing this, you can select the currencies you trade with based on how you think gold’s price movements will move.

If you see that gold’s price is nosediving like it did in late September 2023, you may want to go short on XAU/USD. However, if you think that the value of gold will pick up, you can go long with a currency pair like XAU/AUD for increased profits.

Identify trading opportunities via gold prices’ previous highs and lows

The price of gold remains relatively stable when compared to other trading assets. You’ll want to use this knowledge when you’re coming up with your trading strategy. Gold’s steadiness means it’s likely to reach previous highs and lows it’s already attained—so when you’re conducting your technical analysis via charts, you’ll want to have that historical data in hand to gauge when you should exit your trades.

Take into account economic factors

Gold is an asset that governments, as well as individuals, utilize for financial purposes. Keeping track of the repercussions of these institutions’ gold-related choices can help your trades. For example, central banks often purchase gold to hedge against anticipated volatility. This allows you to both take note of how that central bank’s origin country will affect your currency pair—for example, EUR/GBP falling may mean your XAU/USD currency pair’s value might also drop—as well as to leverage the temporary gold price surge to boost your trades. Use an economic calendar to inform you of significant data releases that might shift the circumstances of trading gold on forex.

Monitor trade positions after they’re executed

Once you’ve opened a position to trade gold on forex, you’ll want to monitor it closely. That way, you can shift gears efficiently when your gold currency pair’s price movements change, helping you maximize profits and minimize losses. You’ll also want to pay attention to other factors that might affect your gold forex trading actions, like swap costs that could detract from your gains if you leave a position open overnight.

For the best effect, you can use a pip calculator to determine how much money you’ll earn or lose if your gold pair’s price were to move by a pip so you can decide how much funds you’re willing to put at stake. The calculator can also help you identify your swap and if you possess enough margin keep your position open as long as you need to maximize returns.

Use software to streamline trading gold on forex

Continuously overseeing your gold and forex trades can be strenuous, especially when you want a high trading volume to enhance your financial performance. To help with that, leverage algorithmic trading software to automate your trades for faster, more efficient, and more precise executions. Simply create a trading strategy for your gold currency pairs and input it into the software’s program. Your algorithmic trading software will then use those predetermined rules to execute your trades without you having to be physically present.

Conclusion

Trading gold on forex can diversify your portfolio and provide opportunities to reap significant returns. Try the above tips to get started.

All Tags

Loading...

Loading...