Investing in precious metals has always been an attractive option for investors looking for a safe haven and a hedge against inflation. Among these precious metals, silver stands out as a popular choice due to its affordability, versatility, and potential for growth. If you are considering adding silver to your investment portfolio, this guide will provide you with the necessary information to make informed decisions and maximize your returns.

Why Invest in Silver?

Investing in silver can be a wise decision for several reasons. Silver is a precious metal that has been used as a form of currency and store of value for centuries. Here are some compelling reasons why investing precious metals such as silver can be beneficial:

Hedge against inflation

Silver has historically been considered a hedge against inflation. When the value of fiat currencies decreases, the price of silver tends to rise. By investing in silver, you can protect your wealth from the erosive effects of inflation.

Diversification

Silver offers diversification benefits to an investment portfolio. It has a low correlation with other asset classes such as stocks and bonds. Adding silver to a portfolio can help reduce overall risk and increase potential returns.

Industrial demand

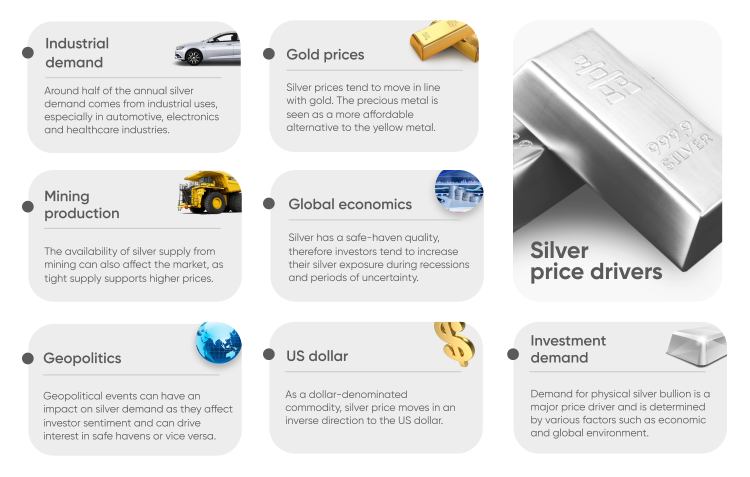

Silver has numerous industrial applications due to its unique properties, such as conductivity and reflectivity. It is widely used in electronics, solar panels, medical equipment, and many other industries. The increasing demand for these applications can drive the price of silver higher.

Limited supply

Unlike fiat currencies, which can be printed at will, the supply of silver is limited. Silver is primarily mined as a byproduct of other metals like copper and gold. As mining costs rise and new discoveries become scarce, the supply of silver may decrease, leading to potential price appreciation.

Tangible asset

Investing in silver provides you with a tangible asset that you can physically hold. Unlike stocks or bonds, which are intangible, silver coins or bullion offer a sense of security and ownership. This tangibility can be appealing to investors who prefer to have a physical presence of their investments.

Store of value

Throughout history, silver has retained its value over time. It has been used as a form of currency and store of wealth across different civilizations. Investing in silver allows you to preserve your purchasing power and protect your wealth over the long term.

Ways to Invest in Silver

Silver is a precious metal that has been used as a form of currency and a store of value for centuries. Here are some ways to invest in silver:

Physical Silver

One of the most traditional ways to invest in silver is by purchasing physical silver in the form of coins, bars, or rounds. These tangible assets can be stored at home or in a secure vault. Physical silver provides a sense of security and ownership and can be easily sold or traded when needed.

Silver Exchange-Traded Funds (ETFs)

ETFs are investment funds that trade on stock exchanges. Silver ETFs allow investors to gain exposure to the price movement of silver without owning physical metal. They provide a convenient and cost-effective way to invest in silver, as they can be bought and sold like stocks. Like Mutual Funds for gold, you can invest in Silver mutual funds or ETFs.

Silver Mining Stocks

Investing in silver mining companies can be another way to gain exposure to the silver market. When purchasing shares of silver mining stocks, investors can benefit from the potential growth and profitability of these companies. However, it is important to conduct thorough research on the company’s financials and management before investing.

Silver Futures and Options

For experienced investors, trading silver futures and options contracts can be a way to speculate on the price movement of silver. These derivative instruments allow investors to profit from both rising and falling silver prices. However, trading futures and options requires in-depth knowledge and understanding of the market.

Silver Bullion Certificates

Silver bullion certificates are documents that represent ownership of physical silver held in a secure vault. These certificates provide a convenient way to hold and trade silver without the need for physical storage. Investors can buy and sell silver bullion certificates through authorized dealers.

Silver Jewelry

Investing in silver jewelry can be an alternative way to invest in silver. While primarily considered a wearable asset, silver jewelry holds intrinsic value due to its silver content. Investors can enjoy wearing their investment while potentially benefiting from the appreciation of the metal’s value over time.

Silver Accumulation Plans

Some companies offer silver accumulation plans, allowing investors to regularly purchase small amounts of silver over time. These plans provide an affordable and systematic way to invest in silver, as investors can contribute a fixed amount each month or quarter.

Factors to Consider

When considering silver as an investment, there are several factors to take into account.

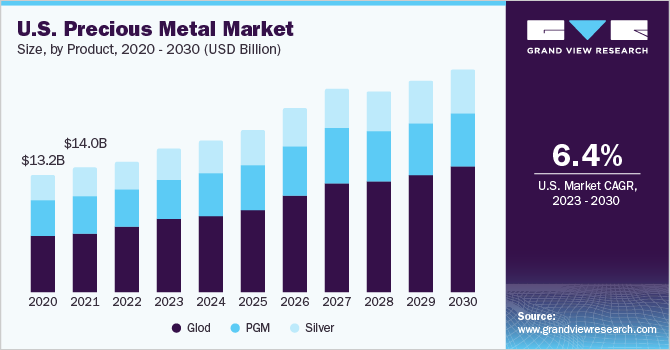

Firstly, it’s important to analyze the current market conditions. This includes examining the supply and demand dynamics of silver. Factors such as industrial demand, jewelry demand, and investment demand can significantly impact the price of silver. Understanding these trends can help investors make informed decisions.

Secondly, it’s essential to consider the macroeconomic environment. Silver is often seen as a safe-haven asset during times of economic uncertainty and inflation. Monitoring factors such as interest rates, inflation rates, and geopolitical events can provide insights into the potential future performance of silver.

Furthermore, investors should assess the storage and liquidity aspects of silver. Unlike other investments, physical silver requires proper storage and security measures. Additionally, investors should consider the ease of buying and selling silver. The liquidity of silver can vary depending on the form in which it is held (bullion coins, bars, or ETFs).

Another factor to consider is the historical performance of silver. Analyzing past price movements and trends can provide valuable insights into potential future performance. However, it’s important to note that past performance does not guarantee future results.

Lastly, investors should evaluate their risk tolerance and investment goals. Silver can be a volatile asset, and it’s crucial to align investments with individual risk preferences and financial objectives.

Risks of Silver Investment

Silver investment can be an attractive option for individuals looking to diversify their investment portfolios. However, like any investment, it is not without its risks. Understanding the risks associated with silver investment is crucial for making informed decisions and managing potential losses. Here are some key risks to consider:

Market Volatility

The price of silver can be highly volatile, influenced by various factors such as economic conditions, geopolitical events, and investor sentiment. Sudden price fluctuations can lead to significant gains or losses, making silver investment a risky endeavor.

Economic Factors

Silver prices are closely tied to the overall health of the global economy. A slowdown in economic growth or a recession can lead to decreased industrial demand for silver, resulting in lower prices. Additionally, changes in interest rates, inflation rates, and currency values can also impact silver prices.

Supply and Demand Dynamics

Silver is used in various industries, including electronics, jewelry, and solar panels. Changes in demand from these sectors can affect the price of silver. Moreover, fluctuations in silver mining production and inventory levels can impact the supply side of the market, leading to price volatility.

Counterparty Risk

Investing in silver through financial instruments such as futures contracts or exchange-traded funds (ETFs) exposes investors to counterparty risk. If the counterparty fails to fulfill their obligations, it can result in financial losses for the investor.

Storage and Security

Physical silver investment requires proper storage and security measures. The risk of theft or damage to silver holdings should be considered when investing in physical silver.

Liquidity Risk

Silver investment may face liquidity challenges, especially during periods of market stress. It may be difficult to find buyers or sellers at desired prices, potentially leading to delays or unfavorable pricing when liquidating silver holdings.

Regulatory and Tax Risks

Changes in regulations or tax policies can impact the profitability of silver investments. Investors should stay informed about any potential regulatory or tax changes that may affect their silver holdings.

Conclusion

Investing in silver can be an excellent addition to a well-diversified investment portfolio. Its historical value, industrial demand, affordability, and potential as an inflation hedge make it an attractive choice for both novice and experienced investors. By understanding the various methods of investing in silver, considering market dynamics and risks, and staying informed about current events that impact the precious metal market, investors can make informed decisions and potentially benefit from the long-term value of silver as an investment asset.