Earned Wage Access (EWA) is increasingly becoming a popular way for workers to access their wages on-demand. This is an innovative financial solution that has gained traction in recent years. It provides employees with access to their earned wages before payday. This can be a great help for those facing financial emergencies or short-term cash flow issues. By understanding what EWA is and how it works, employers and employees alike can take advantage of the benefits it offers.

What is Earned Wage Access?

Earned Wage Access (EWA) gives employees greater access to the money they’ve already earned. It works by linking payroll data with a digital wallet to allow individuals to access their wages. As soon as the workers have earned them. This means that instead of having to wait until payday, workers can access their wages in real-time. This can help them stay on top of their finances and make it through tight times with ease.

The Earned Wage Access can be used to cover a wide range of expenses. Such as day-to-day costs like groceries to unexpected bills and expenses. By allowing individuals to access their wages as soon as they are earned, EWA helps them take control of their finances. This allows them manage their cash flow better. It also helps employers build trust with their workforce. This is also offering added value without the additional cost or complexity of traditional payroll solutions.

With Earned Wage Access, individuals can access earned wages anytime between their paydays. This payment cycle is different from that of traditional payroll processes, which pays employees in arrears and may stretch as far as two or three weeks after the employee has already worked the hours. Through Earned Wage Access, employees get paid within minutes of completing a shift, ensuring they are able to cover needs like rent and groceries. By providing this added financial security and freedom, EWA helps workers take control of their finances more effectively and manage cash flow better.

How Does Earned Wage Access Work?

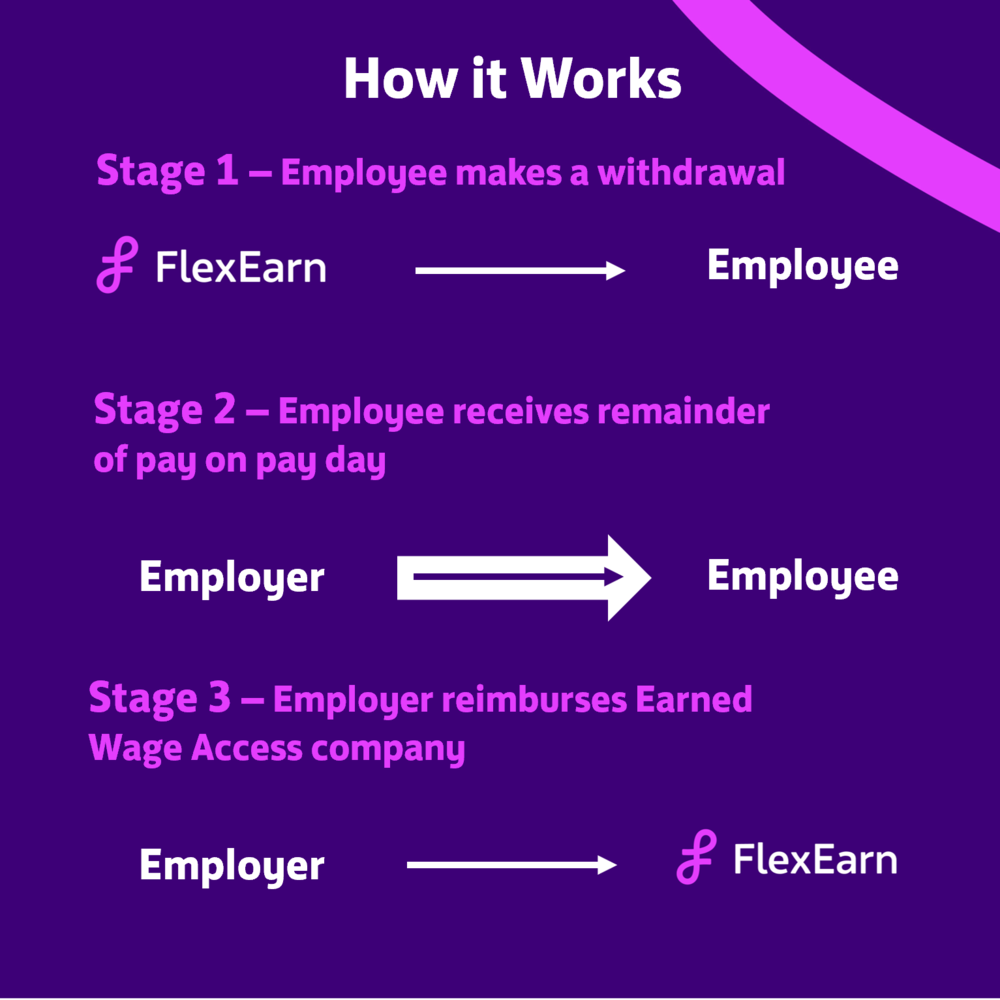

Earned Wage Access works by connecting your employer’s payroll system with a digital wallet that you control. Your wages are automatically deposited into your digital wallet, giving you access to any accrued funds after every shift and helping to smooth out variations in income. You can use the funds for whatever you need, and depending on your provider, you may also have access to additional tools and services such as budgeting advice or automated saving options.

This program allows employees to access their earned wages in real-time, breaking the cycle of payday lags and overdraft fees. As soon as income is reported to the digital wallet, it’s immediately available and accessible for you to use. This can help reduce reliance for short-term loans, like payday loans, resulting in increased financial security and a smoother cash flow. At the same time, employers benefit from increased retention as employees no longer need to worry about having enough money between paychecks.

The cash flow challenge is especially relevant in the gig economy. With part-time jobs, juggling multiple contracts and fluctuating income throughout the month can be difficult to manage with a traditional paycheck system. Earned Wage Access makes it easier for organizations, including gig employers and temporary staffing companies, to give employees immediate access to their money so they can purchase needed goods and services when their wages are earned—not two weeks later at payday.

Who is Eligible for Earned Wage Access?

Earned Wage Access is offered to eligible employees in the gig-economy, retail and hospitality industry, as well as other sectors. To be eligible for Earned Wage Access you must have an employer that offers EWA benefits, you must sign up for an eligible digital wallet service and provide any necessary details such as your bank information. The eligibility requirements vary by provider so it’s important to read the terms and conditions before signing up for any Earned Wage Access program.

Earned Wage Access also require that you must have an eligible smartphone and an active internet connection in order to sign up. You should also have a valid email address or phone number associated with your accounts for receiving notifications about your available funds, as well as their transaction details.

It’s important to note that some Earned Wage Access providers may require you to earn a certain amount per pay period before you can use the program, or impose wages caps or other restrictions on who is eligible for their services. Therefore, it’s essential to read all of the fine print before signing up so that you are aware of all of the conditions of using Earned Wage Access.

To take advantage of Earned Wage Access, it’s important that you are an employee with a reliable income. Most earned wage access providers will only work with employees who have direct deposit options for their payments, either set up through their employer or through another banking institution.

What Are the Benefits of Earning wage access?

Earned Wage Access can provide a number of benefits to employees. Most notably, access to wages before payday allows for quicker access to funds. This means that employees can use those funds when necessary right away. Instead of having to wait until their next check day. Other benefits related to EWA include more convenient budgeting options and better financial peace of mind . Also gives them potential savings on late payment fees and overdraft fees.

Earned Wage Access can be especially beneficial for employees that are living paycheck to paycheck. With access to funds before their check day, these individuals can pay for necessities like groceries or rent on time. They can avoid the accrual of late fees and other penalties. Furthermore, EWA can reduce stress for those who have to juggle bill due dates throughout the month until their check arrives.

With this system, they know that they’ll have the money they need in advance to stay ahead of their bills. In essence, it helps employees gain more control and flexibility over their finances. Also this will be ensuring that they are able to meet all of their financial obligations without difficulty.

But it’s not just employees who benefit from earned wage access. Employers can also glean advantages from EWA: offering these features to their workers can help them attract and retain top talent while increasing satisfaction and commitment among staff. Additionally, since EWA helps reduce the number of complaints about paydays altogether, businesses have the opportunity to save time and money that would otherwise be spent dealing with payroll-related issues.

With time more effectively allocated, employees can stay focused on achieving organizational goals and meeting the needs of customers. All in all, earned wage access offers a mutually beneficial relationship between employers and employees that helps ensure everyone’s success.

Are There Any Drawbacks to Using EWA?

As with any type of financial service, there may be some drawbacks to using Earned Wage Access that should be considered. The biggest potential drawback is the risk of overspending. With access to wages before payday, workers may be more likely to spend their full paycheck before payday, leaving them without funds until the next pay period. Additionally, there may be fees associated with using EWA services that could negatively impact a worker’s overall finances depending on how much they are using it.

It’s important to consider that early access to wages may create confusion due to the need to track where, when and how much money you are being paid. Payroll team will need this in order to budget for upcoming bills and expenses. This can be critical for those living paycheck-to-paycheck. So it is important to be aware of what is owed from paycheck to paycheck and keep a detailed budget on spending.

Interim Payroll Process Challenges

Finally, EWA may lead workers into a potentially dangerous cycle of relying on short-term credit. If not used correctly — meaning that if wage access fees aren’t taken into account and planned for over time, the worker may find themselves in more debt than anticipated.

The potential for falling into a short-term credit cycle is not the only potential drawback to using EWA. If there are insufficient funds in an employee’s checking account when their employer pays them via EWA, those payments may overdraw their account and incur hefty fees from their bank or financial institution.

Additionally, many employers who offer EWA typically offer fee-based options which can be expensive over time. Because of their fees, these types of services need to be used responsibly and budgeted for in advance as they will most likely take away from the total amount you earn during each paycheck period.

EWA Program for Manufacturing Industry

The Earned Wage Access (EWA) program has been gaining popularity in the manufacturing industry, and for good reason. This innovative program allows employees to access their earned wages before payday, providing them with financial flexibility and stability. With EWA, employees can avoid costly overdraft fees or high-interest loans that could leave them in debt.

Manufacturing companies have been quick to adopt EWA programs. They recognize the positive impact on employee morale and retention rates. By offering this benefit, employers can attract new talent while also retaining their current workforce. Employees who are financially secure are more likely to be engaged at work . They are less likely to experience stress or anxiety related to finances.

In addition, EWA programs can also benefit employers by reducing administrative costs associated with payroll processing. As these programs typically integrate with existing payroll systems, there is no need for additional paperwork or time-consuming processes. EWA program can be very helpful for Jewelry Karigars, Weekly contract workers to get paid after their shift is completed.

Earned Wage Access for Retail Workers

The EWA program is an innovative financial solution that has been designed to assist employees in the retail industry. It allows workers to access their earnings before payday. This program can help them avoid high-interest loans and other forms of debt. EWA programs have become increasingly popular in recent years as more employers recognize the benefits they offer.

For retail workers who often experience unpredictable schedules and fluctuating paychecks, EWA programs can provide a sense of financial stability. The program ensures that workers get paid for all the hours they’ve worked. They don’t have to wait for payroll processing or traditional payday schedules. According to studies, offering EWA programs not only boosts employee satisfaction but also increases retention rates.

Providing an EWA program for employees in the retail industry is a win-win situation for both employers and workers. In countries like India, where employees and workers still get paid partly on Cash, EWA will help them. Countries where salary is paid on a Monthly basis, EWA program will be beneficial to these regions.

Fintech Startups in EWA

Fintech startups have been making waves across the globe. EWA has emerged as one of the most popular areas of focus. This revolutionary payment solution is gaining traction among businesses and employees alike in EWA. They are providing a means to access earned wages before payday. Many fintech startups now vying for a slice of the market share in this domain. There has never been a better time to explore the potential of EWA.

The rise of fintech companies in EWA is transforming traditional payroll systems by offering innovative solutions . Solutions. that allow employees to access their earnings whenever they need them. Such solutions are ideal for workers who may be experiencing financial difficulties . This may be due to unforeseen expenses or emergencies.

Companies that are dealing with Blue Collar Workers, Gig Workers or Hourly Wage workers are highly benefited from EWA Program.

- Instant Financial helps businesses give their employees daily access to their earned pay.

- Wagely helps businesses offer employees to access earned but unpaid wages.

- Refyne‘s technology integrates with employers’ payroll to offer employees with real-time access to pay they earned.

and many more companies are providing Financial Wellness to their employees- both full time and contracts.

Final Thoughts

In conclusion,Earned Wage Access provides a way for workers to access wages in advance. This is helping them manage their finances more effectively. With EWA, employers are able to provide an additional benefit that is not available with traditional payroll practices . The one that is highly valued by employees. On the other hand, there are potential risks associated with EWA, such as data security and financial risk. As EWA process gets streamlined, more employers would adopt a better Payroll solutions for their employees.