Rapaport Diamond Report- Why you should Read

Veejay Ssudhan

July 30, 2025If you’re a diamond enthusiast—whether you collect, invest, trade, or simply have a deep fascination for these incredible gems—the Rapaport Diamond Report is something you should know inside and out. This widely recognized report isn’t just for professional jewelers or dealers; it’s an invaluable tool for anyone passionate about diamonds. Let’s explore why the Rapaport Diamond Report deserves a place in your diamond journey.

What is the Rapaport Diamond Report?

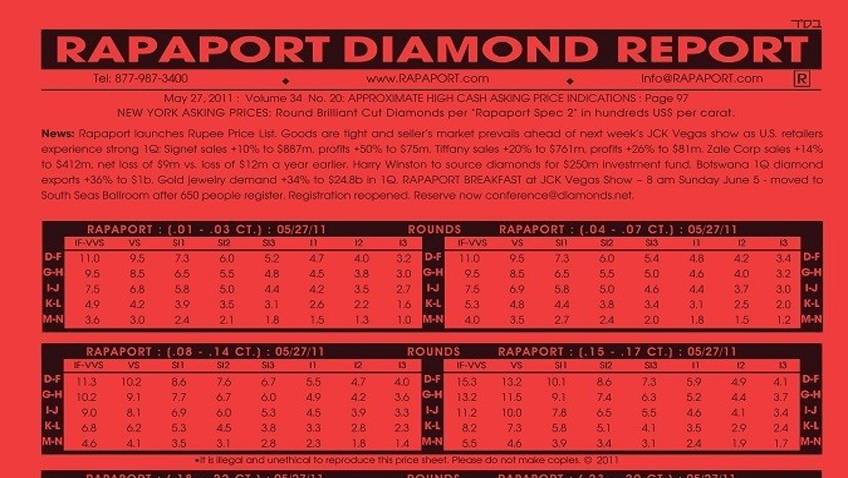

The Rapaport Diamond Report, often simply called the “Rap Sheet,” is a price list and market analysis published weekly by the Rapaport Group. Founded by Martin Rapaport in 1978, the report quickly became the global standard for diamond pricing. It lists the average asking prices for polished diamonds, based on carat weight, color, and clarity, and is widely used to guide transactions in the diamond industry.

Why Should A Diamond Enthusiast Care?

1. Understanding True Market Value

Diamonds don’t have a single “retail price.” Unlike gold (which is traded on exchanges with clear daily prices), diamond prices can vary dramatically depending on where you buy, who you buy from, and details like cut quality. The Rapaport Price List provides a standardized reference point. If you want to know whether a price is fair or inflated, the Rap Sheet is your best friend. It helps you navigate negotiations, auctions, and even private sales with confidence.

2. Learning How Diamonds Are Valued

The report organizes prices according to the famous “Four Cs”: carat weight, color, clarity, and cut (though cut is less detailed in the list). By studying the Rap Sheet, you’ll see firsthand how each of these factors affects value. For example, you’ll notice that prices jump at certain carat weights (“magic sizes” like 1.00 ct or 2.00 ct) or that small differences in color grade may mean large price changes. Over time, you’ll develop a much sharper eye for evaluating diamonds yourself.

3. Tracking Market Trends

Like any market, diamond prices move up and down with supply and demand. If you’re passionate about diamonds as an investment or collectible, tracking these trends is essential. The Rapaport Report shows weekly price changes and includes commentary on what’s happening in the market:

Are certain sizes or grades rising? Is demand shifting to lab-grown diamonds? Staying informed lets you make smarter buying (or selling) decisions.

4. Avoiding Overpaying

Jewelry retailers often set their own prices, which can be far above wholesale rates. Without a reference like the Rap Sheet, it’s easy to overpay—sometimes by thousands of dollars. When you know the approximate “dealer” value of a diamond, you gain negotiating power. Even if you’re not buying from a wholesaler, knowledge of base market pricing helps ensure a fair deal.

5. Empowering Your Passion

Being able to talk confidently about diamond values and market conditions sets you apart from casual fans. If you’re active in online forums, social media groups, or local gem clubs, referencing the Rapaport Report makes your insights more respected and credible.

How Does the Rapaport Diamond Report Work?

The report is organized in tables according to shape (rounds and fancies), carat weight (broken into ranges), color (graded D-Z), and clarity (IF to I3). Each cell in the table lists a price per carat in hundreds of U.S. dollars.

For example:

- A 1-carat round diamond graded G color and VS2 clarity might have a list price of $7,800 per carat.

- The same size but with H color and SI1 clarity drops to $5,500 per carat.

These are not the final prices you’ll find at your local jeweler—think of them as benchmarks for negotiation.

What the Report Is (and Isn’t)

It’s important to remember that the Rapaport Report gives asking prices, not transaction prices. Actual deals are often done at discounts (sometimes premiums for exceptional stones). The report doesn’t account for cut quality in detail or special factors like fluorescence, provenance, or branded cuts.

Also, it focuses on loose polished diamonds—not mounted stones or fancy colored diamonds (which are covered separately).

How To Access The Rapaport Diamond Report

The full report is available by subscription through the Rapaport website (www.diamonds.net). There’s an annual fee, but many enthusiasts consider it well worth the investment for serious collecting or trading. Some jewelers may show you relevant pages if you ask during a purchase discussion.

Tips for Using the Report as an Enthusiast

- Learn How To Read It: Take time to understand how the tables are structured and what each abbreviation means.

- Check Often: Prices can change weekly based on global factors—don’t rely on old data.

- Factor In Discounts: If you’re negotiating or buying wholesale, expect actual selling prices to be below list.

- Use for Reference: The report is best used as a guide rather than a strict rule for what every diamond “should” cost.

Beyond Price: Insights from Rapaport

The Rapaport Group also publishes market news, analysis, auction results, and ethical sourcing updates. Following their commentary gives you deeper insight into trends—like the rise of lab-grown diamonds or shifts in consumer demand—which can affect your collecting strategy.

Final Thoughts

For anyone passionate about diamonds—whether as an investor, collector, hobbyist, or simply someone who loves learning—the Rapaport Diamond Report is much more than an industry tool. It’s your window into how diamonds are valued worldwide, helping you make smarter decisions and deepening your appreciation for these fascinating stones.

Arming yourself with this knowledge transforms diamond collecting from guesswork into a true craft. Whether you’re buying your first loose stone or adding rare gems to your collection, using the Rap Sheet ensures you do so with confidence and expertise.

In short: If you love diamonds, make the Rapaport Diamond Report part of your toolkit—you’ll never look at these sparkling gems the same way again.

All Tags

Loading...

Loading...