A Comprehensive Guide to Rhodium Price

The Mintly Team

November 25, 2023Rhodium is one of the rarest and most valuable precious metals on Earth. It is a platinum group metal (PGM) that is used in several industries, including the automotive, electronics, and jewelry sectors. The price of rhodium is dictated by several factors, including supply and demand dynamics, geopolitical influences, and economic indicators. Understanding rhodium prices is crucial for anyone interested in investing in this precious metal.

The Rarity of Rhodium

The rarity of rhodium can be attributed to several factors.

Firstly, rhodium is found in very small quantities in the Earth’s crust. It is estimated that the total amount of rhodium present in the Earth’s crust is only around 0.001 parts per million. This scarcity makes it difficult and expensive to extract and refine rhodium from its ores.

Secondly, the primary source of rhodium is as a byproduct of platinum and nickel mining. Since rhodium is usually found in association with these metals, its production is dependent on the mining of these primary metals. The limited availability of platinum and nickel ores further contributes to the rarity of rhodium.

Additionally, the demand for rhodium has been steadily increasing in recent years, particularly in the automotive industry. Rhodium is used as a catalyst in catalytic converters, which help reduce harmful emissions from vehicles. As countries around the world implement stricter emission standards, the demand for rhodium in catalytic converters has surged, further exacerbating its rarity.

Due to its scarcity, rhodium prices have skyrocketed in recent years. In fact, rhodium metal has become one of the most expensive precious metals, surpassing even gold and platinum in value. This high price reflects both the limited supply and the growing demand for rhodium.

Supply and Demand Dynamics of Rhodium

The supply and demand dynamics of rhodium have a significant impact on its price and availability in the market.

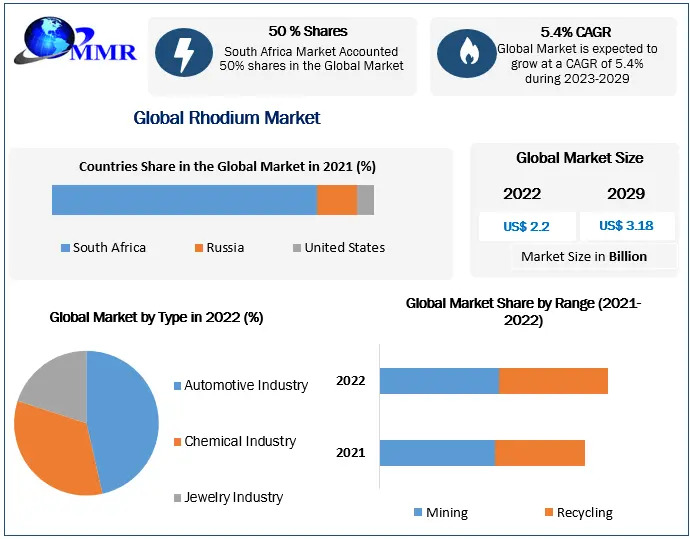

On the supply side, rhodium is primarily extracted as a byproduct of platinum and palladium mining. South Africa, Russia, and Zimbabwe are the largest producers of rhodium, with South Africa being the dominant player. The mining process for rhodium is complex and expensive, making it challenging to increase production quickly.

The demand for rhodium has been steadily increasing in recent years. One of the main drivers of demand is the automotive industry, where rhodium is used in catalytic converters to reduce emissions from vehicles. As countries around the world tighten their emissions standards, the demand for rhodium in the automotive sector is expected to continue growing. Additionally, rhodium is used in the production of specialty chemicals, glass, and jewelry, further contributing to its demand.

The limited supply and growing demand have led to a significant increase in the price of rhodium. In fact, rhodium has experienced substantial price volatility in the past decade. For example, from 2016 to 2020, the price of rhodium surged more than tenfold, reaching record highs. This price surge was mainly driven by increased demand from the automotive industry and supply disruptions in South Africa.

The price of rhodium is also influenced by factors such as economic conditions, geopolitical events, and investor sentiment. For instance, during periods of economic growth, the demand for automobiles tends to rise, leading to higher demand for rhodium. On the other hand, during economic downturns, the demand for rhodium may decline, putting downward pressure on its price.

Geopolitical Influences

Rhodium, a rare and valuable metal, holds significant geopolitical influence due to its various applications and limited global supply. This precious metal plays a crucial role in several industries, including automotive, electronics, and chemical manufacturing. Its unique properties make it highly sought after, leading to a competitive global market and geopolitical implications.

One of the primary geopolitical influences of rhodium is its impact on the automotive industry. One of the precious metals catalytic converter is Rhodium. It helps reduce harmful emissions from vehicles. As countries around the world strive to meet stringent environmental regulations, the demand for rhodium in the automotive sector continues to rise. This creates geopolitical tensions as countries compete for limited supplies of rhodium to meet their emission reduction targets.

Furthermore, the electronics industry heavily relies on rhodium for its exceptional conductivity and resistance to corrosion. It is widely used in the production of electrical contacts and connectors. With the increasing demand for electronic devices such as smartphones, laptops, and electric vehicles, the geopolitical influence of rhodium extends to the competition for resources among countries involved in the electronics industry.

Impact on Chemical Manufacturing

Moreover, rhodium’s significance in the chemical manufacturing sector adds to its geopolitical implications. It is used as a catalyst in various chemical reactions, particularly in the production of nitric acid, which is essential for the manufacture of fertilizers and explosives. As countries aim to strengthen their chemical industries and secure a stable supply of essential chemicals, the geopolitical dynamics surrounding rhodium become more pronounced.

The limited global supply of rhodium also contributes to its geopolitical influence. South Africa is the largest producer of rhodium, followed by Russia. The concentration of production in a few countries creates dependence and vulnerability in the global market. Any disruptions in the supply chain can have significant geopolitical ramifications, leading to price fluctuations and potential conflicts over access to rhodium resources.

Economic Indicators

As one of the rarest and most expensive metals in the world, Rhodium’s economic indicators provide valuable insights into global economic trends and market conditions.

One of the key economic indicators of Rhodium is its price, which fluctuates based on supply and demand dynamics. The price of Rhodium reached an all-time high in 2020, surpassing even the price of gold. This surge in price can be attributed to several factors, including increased demand from the automotive sector for catalytic converters and stricter emissions regulations worldwide.

Another important economic indicator for Rhodium is its production and supply. Rhodium is primarily mined as a by-product of platinum and palladium mining. South Africa is the largest producer of Rhodium, followed by Russia and Zimbabwe. Any disruptions or changes in mining activities in these countries can have a significant impact on the global supply of Rhodium, leading to price fluctuations.

Rhodium’s economic indicators also reflect its role as a hedge against inflation and economic uncertainty. During times of economic instability or market volatility, investors often turn to precious metals like Rhodium as a safe haven investment. This increased demand for Rhodium as a store of value can drive up its price.

Furthermore, Rhodium’s economic indicators can provide insights into the state of the automotive industry. As mentioned earlier, Rhodium is used in catalytic converters to reduce harmful emissions from vehicles. Therefore, an increase in demand for Rhodium can indicate a growing automotive sector, while a decrease may suggest a slowdown in the industry.

Investing in Rhodium

One of the primary reasons investors consider investing precious metals such as rhodium is its potential for substantial returns. The metal has experienced remarkable price appreciation in the past decade, making it an attractive investment opportunity. Its scarcity, coupled with increasing demand from emerging economies, has contributed to its price surge.

Moreover, rhodium has a strong correlation with the automotive industry, particularly in the production of catalytic converters. As governments worldwide continue to enforce stricter emission standards, the demand for rhodium is expected to rise. This connection to a vital industry adds stability to rhodium’s investment potential.

However, it is important to note that investing in rhodium carries certain risks. The metal’s price volatility can be significant, leading to potential losses for investors. Additionally, rhodium is not as readily accessible as other precious metals like gold or silver, making it less liquid.

Investing in rhodium can be done through various means, including physical ownership or exchange-traded funds (ETFs) that track rhodium prices. It is crucial for investors to conduct thorough research and seek professional advice before entering this market.

Conclusion

Understanding the factors that drive rhodium prices can help investors make informed decisions about whether to include this precious metal in their investment portfolios. While the high price of rhodium can be attractive, it’s essential to understand the risks involved and to keep an eye on supply and demand dynamics, geopolitical influences, and economic indicators. As with any investment, thorough research and careful consideration of your investment goals and risk tolerance are crucial.

All Tags

Loading...

Loading...