Central banks are major players in the precious metals market, and their actions can have a significant impact on the price of gold, silver, and other metals. Central banks can influence the price of precious metals, such as gold and silver, through several mechanisms. Understanding the role of central banks in this market can help investors make informed decisions about their investments. In this post, we’ll explore the ways in which central banks influence the precious metals market and what it means for investors.

What are central banks and why do they matter?

Central banks are financial institutions that are responsible for managing a country’s monetary policy. They are typically government owned and operate independently of political influence. Central banks play a crucial role in maintaining economic stability and controlling inflation.

They also hold significant amounts of gold and other precious metals as part of their foreign exchange reserves. As such their actions in the precious metals market can have a significant impact on the price of these metals. Understanding the role of central banks is important for investors who want to make informed decisions about their investments in precious metals.

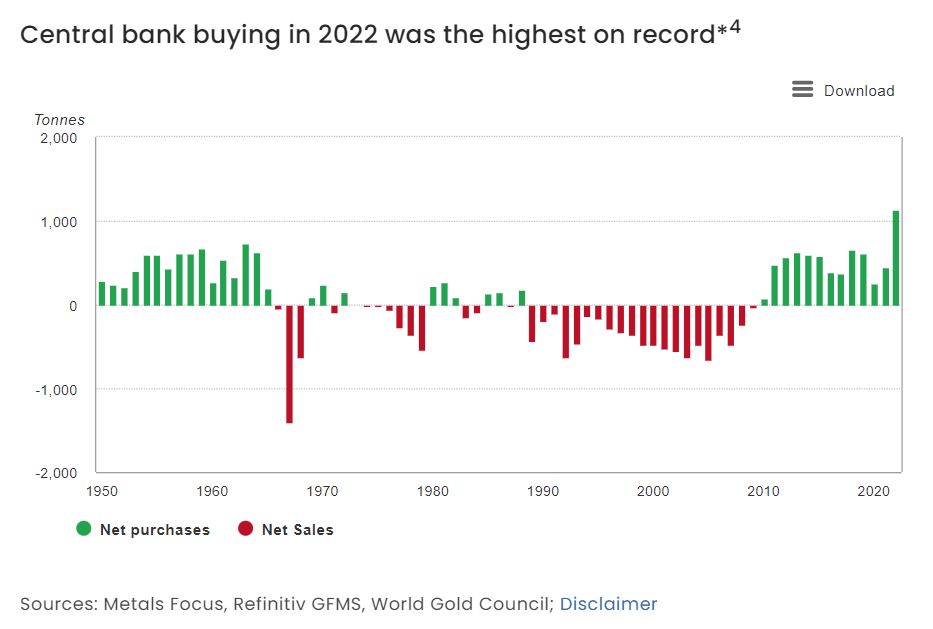

Central banks have historically played a significant role in the precious metals market. They hold large amounts of gold and other precious metals as part of their foreign exchange reserves, which they use to stabilize their currencies and support their economies. Central banks can also influence the price of precious metals through their buying and selling activities.

For example if a central bank decides to sell a large amount of gold it can cause the price of gold to drop. On the other hand if a central bank decides to buy gold, it can drive up the price. As such investors in the precious metals market need to pay close attention to the actions of central banks and their impact on the market.

Central banks and interest rates

One of the ways that central banks can influence the price of precious metals is through changes in interest rates. When a central bank raises interest rates, it can make holding precious metals less attractive to investors as they can earn higher returns on other investments. This can lead to a decrease in demand for precious metals and a subsequent decrease in their price. On the other hand, when a central bank lowers interest rates, it can make holding precious metals more attractive, leading to an increase in demand and price. Central banks also use other tools, such as quantitative easing, to influence the economy and the price of precious metals.

Central banks play a significant role in the precious metals market, as their policies can have a direct impact on supply and demand. Interest rates are one of the most important tools that central banks use to influence the economy and financial markets. When interest rates rise, borrowing becomes more expensive, which can slow down economic growth and reduce inflation. This can lead to a decrease in demand for precious metals, as investors may seek higher returns elsewhere.

Conversely, when interest rates are lowered, borrowing becomes cheaper, which can stimulate economic growth and increase inflation. This can make holding precious metals more attractive, leading to an increase in demand and price. Central banks also use other tools, such as quantitative easing, to influence the economy and the price of precious metals. Overall, the actions of central banks can have a significant impact on the precious metals market, and investors should pay close attention to their policies and decisions.

Central banks and quantitative easing

Quantitative easing is a monetary policy tool used by central banks to stimulate the economy. It involves the central bank buying large amounts of government bonds or other securities, which increases the money supply and lowers interest rates. This can lead to increased borrowing and spending which can stimulate economic growth. However it can also lead to inflation and a decrease in the value of the currency. The use of quantitative easing can also impact the price of precious metals, as investors may turn to them as a hedge against inflation and a weakening currency.

Central banks play a significant role in the precious metals market, particularly during times of economic uncertainty. As central banks engage in quantitative easing, the increased money supply can lead to inflation which can cause investors to turn to precious metals as a safe haven investment. This increased demand can drive up the price of precious metals, making them a valuable asset for investors.

Additionally central banks themselves may hold significant amounts of gold and other precious metals as a reserve asset, which can also impact the market. Overall, the actions of central banks can have a significant impact on the precious metals market and the value of these assets.

Central banks and currency exchange rates

Central banks play a crucial role in determining currency exchange rates. They can influence exchange rates through various monetary policy tools, such as adjusting interest rates or intervening in foreign exchange markets. When a central bank raises interest rates, it can attract foreign investment and strengthen the currency. This can make precious metals, which are priced in dollars, more expensive for foreign buyers.

On the other hand, when a central bank lowers interest rates, it can weaken the currency and make precious metals more attractive as a safe-haven investment. Therefore, it’s important to keep an eye on central bank actions when investing in precious metals.

Central banks also hold significant amounts of gold reserves which can affect the precious metals market. For example, when central banks sell off their gold reserves, it can put downward pressure on gold prices. Conversely when central banks increase their gold reserves, it can boost demand and drive up prices.

Additionally, central banks can influence the supply of precious metals by regulating mining and production. Overall, the actions of central banks can have a significant impact on the precious metals market, and investors should stay informed about their policies and decisions.

The impact of central bank actions on precious metal prices

Central banks have a significant impact on the price of precious metals. Their actions can influence the value of currencies which in turn affects the price of metals like gold, silver, and platinum. For example, if a central bank raises interest rates, it can strengthen the currency and make precious metals more expensive for foreign buyers. Conversely, if a central bank lowers interest rates it can weaken the currency and make precious metals more attractive as a safe-haven investment. It’s important for investors to keep an eye on central bank actions and their potential impact on the precious metals market.

Central banks also hold significant amounts of gold in their reserves which can affect the supply and demand dynamics of the precious metals market. If a central bank decides to sell a large amount of gold it can flood the market and drive down prices. On the other hand, if a central bank decides to buy gold, it can create increased demand and drive up prices. Additionally central banks can use their influence to manipulate the price of precious metals through futures contracts and other financial instruments.

As such, it’s important for investors to stay informed about central bank actions and their potential impact on the precious metals market.

Market Sentiment

Central banks play a crucial role in shaping market sentiment through their policy decisions, economic outlooks, and public statements. If central banks express concerns about economic growth, financial stability, or inflation, investors may seek safe-haven assets like precious metals to protect their wealth, driving up prices.

Central banks play a crucial role in shaping market sentiment through their policy decisions, economic outlooks, and public statements. By implementing monetary policy and providing guidance on economic conditions central banks can directly or indirectly impact the financial markets and investor behavior. Here is how central banks shape market sentiment:

Monetary policy decisions

Central banks set interest rates and implement other monetary policies to achieve specific economic objectives, such as controlling inflation, promoting economic growth, and maintaining financial stability. Changes in interest rates and monetary policy can significantly impact various asset classes. This may be including stocks, bonds, and currencies. Market participants closely monitor these decisions and adjust their investment strategies accordingly.

Forward guidance

Central banks often provide forward guidance to communicate their expectations about the future path of monetary policy. This guidance can include information about the likely direction of interest rates, the central bank’s views on economic conditions and potential policy actions. Forward guidance helps reduce uncertainty and provides a framework for investors to form expectations about future market conditions, which can influence their investment decisions.

Economic outlooks

Central banks regularly publish economic outlooks, which provide forecasts and analysis of key economic indicators, such as GDP growth, inflation, and unemployment. These outlooks help market participants gauge the health of the economy, identify potential risks, and make informed investment decisions. A positive outlook can boost market sentiment while a negative outlook can lead to increased caution among investors.

Public statements and speeches:

Central bank officials, including governors and board members often make public statements and deliver speeches to share their views on the economy, monetary policy, and other relevant topics. These statements can provide insights into the central bank’s thinking and potentially signal upcoming policy changes. Market participants closely follow these statements, as they can have a significant impact on market sentiment and investor behavior.

Crisis management and interventions:

During periods of financial instability or crisis, central banks can play a crucial role in restoring market confidence through various measures, such as providing liquidity to financial institutions, implementing emergency lending facilities, or coordinating with other central banks and regulatory authorities. By acting as a lender of last resort and stabilizing the financial system, central banks can help restore market sentiment and prevent panic from spreading.

Central banks can shape market sentiment through their monetary policy decisions, economic outlooks, public statements, and crisis management interventions. These actions can influence investor behavior, impact asset prices, and ultimately contribute to the overall stability and functioning of financial markets. Market participants closely follow central bank actions and statements to guide their investment decisions and assess the health of the economy.

Final Thoughts

In conclusion, central banks play a significant role in influencing the price of precious metals. The actions taken by these banks have far-reaching consequences that affect investors and financial markets globally. From buying and selling gold reserves to adjusting interest rates, it is clear that central banks hold immense power when it comes to shaping the price of precious metals.

As such, investors should keep a close eye on the decisions made by these institutions and factor them into their investment strategies. With this knowledge, people can make informed decisions about their investments in precious metals. Don’t miss out on any potential opportunities or pitfalls – stay informed!