Macroeconomic factors driving gold price: A Guide

The Mintly Team

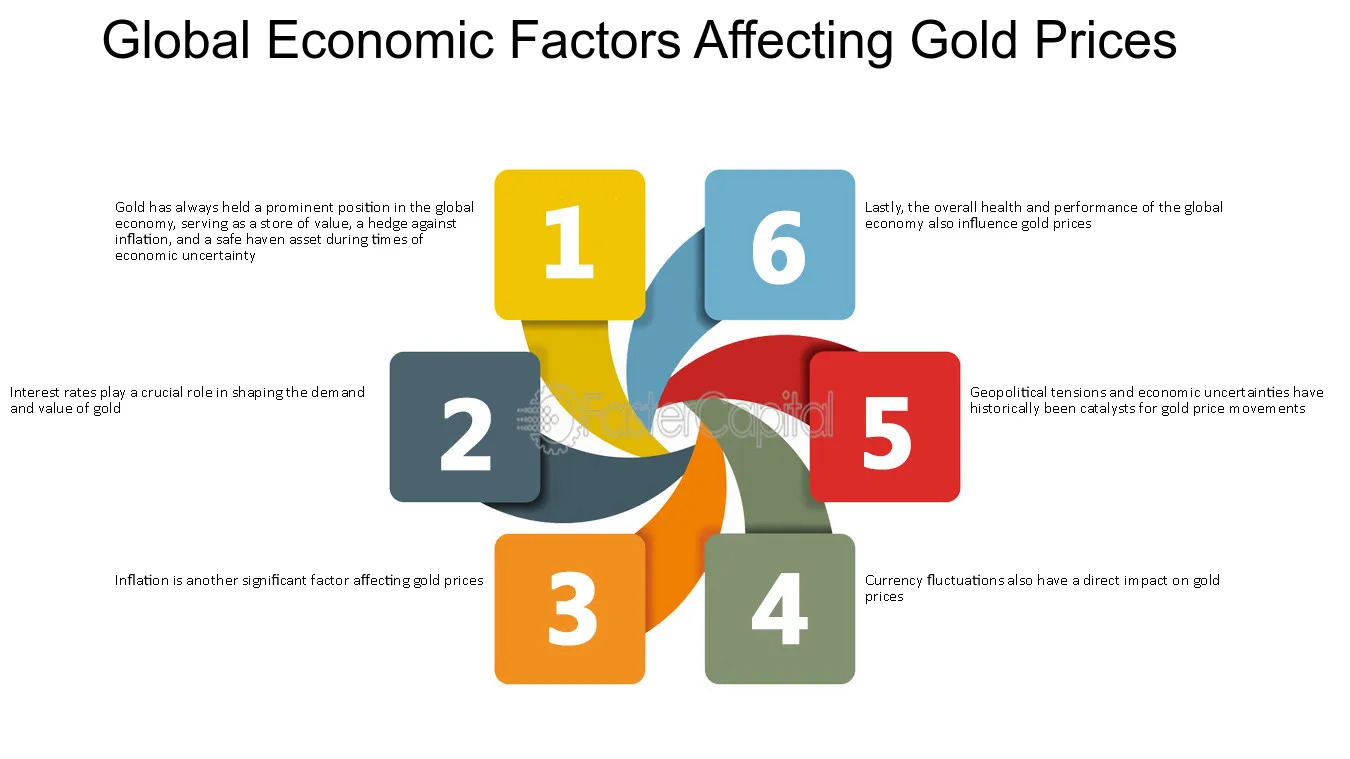

April 29, 2024Gold has been a symbol of wealth and power for centuries. Beyond its cultural significance, gold is also a key player in the global economy. The price of gold is influenced by a variety of macroeconomic factors that reflect the overall state of the economy. In this guide, we will explore some of the main macroeconomic factors that drive the price of gold.

Inflation

Inflation is a critical macroeconomic factor that significantly influences the price of gold. As the general price level of goods and services in an economy rises, the purchasing power of the currency decreases, leading to inflation. In times of high inflation, investors often turn to gold as a hedge against the diminishing value of paper currency.

Gold is considered a store of value and a safe haven asset that retains its worth over time. When inflation erodes the value of traditional investments like stocks and bonds, gold tends to retain its purchasing power, making it an attractive investment option.

Central banks often use monetary policy tools like interest rate adjustments to control inflation. When interest rates are low, the opportunity cost of holding gold decreases, making it more appealing to investors.

Interest Rates

Interest rates play a crucial role in influencing the price of gold in macroeconomics. When interest rates rise, the opportunity cost of holding gold increases as it does not generate any interest or dividends. Investors may prefer to invest in interest-bearing assets like bonds, leading to a decrease in the demand for gold and consequently a decrease in its price.

Conversely, when interest rates fall, the appeal of holding gold increases as the opportunity cost of holding non-interest-bearing assets decreases. This can lead to an increase in the demand for gold and, subsequently, an increase in its price.

Central banks often adjust interest rates to control inflation and economic growth. As a result, changes in interest rates can have a significant impact on the overall economy and financial markets, including the price of gold. Investors closely monitor interest rate decisions and economic indicators to anticipate future changes that may affect the price of gold.

Currency Movements

Currency movements play a crucial role in influencing the price of gold in the global market. Gold is traded in US dollars, making it highly sensitive to fluctuations in currency values. As currencies strengthen or weaken against the dollar, the price of gold tends to move inversely.

When a currency strengthens against the US dollar, the price of gold typically decreases. This is because a stronger currency makes gold more expensive for holders of that currency, leading to a decrease in demand. On the other hand, when a currency weakens against the US dollar, the price of gold tends to rise. A weaker currency makes gold cheaper for holders of that currency, increasing demand for the precious metal.

Moreover, currency movements can also reflect broader macroeconomic factors that impact the gold market. For instance, if a currency depreciates due to economic uncertainty or geopolitical tensions, investors may turn to gold as a safe-haven asset, driving up its price.

Geopolitical Uncertainty

Geopolitical uncertainty plays a significant role in influencing gold prices today in the macroeconomic landscape. When geopolitical tensions rise, investors often turn to gold as a safe-haven asset, driving up its demand and price. This is because gold is seen as a reliable store of value during times of instability and crisis.

Events such as political conflicts, trade disputes, or military tensions can create uncertainty in the global economy, leading to a flight to safety towards assets like gold. The fear of economic downturns or currency devaluations due to geopolitical factors prompts investors to seek refuge in gold, thereby boosting its value.

Moreover, geopolitical uncertainty can impact supply chains and global trade, affecting currencies and financial markets. As a result, investors view gold as a hedge against such risks, further propelling its price upwards. In essence, the relationship between geopolitical uncertainty and gold prices underscores the metal’s role as a traditional safe haven asset in times of turmoil.

Economic Data Releases

Economic data releases play a crucial role in influencing the price of gold as a macroeconomic factor. When key economic indicators such as GDP growth, inflation rates, employment data, and interest rates are released, they can significantly impact the demand for gold. For instance, strong economic data suggesting robust growth may lead to higher interest rates by central banks. This can increase the opportunity cost of holding non-interest-bearing assets like gold, thereby lowering its appeal.

Conversely, weak economic data indicating economic uncertainties or potential downturns may drive investors towards safe-haven assets like gold, boosting its price. Investors closely monitor these data releases to assess the overall health of the economy and make informed decisions regarding their gold investments.

Supply and Demand

Supply and demand play a crucial role in determining the price of gold in the macroeconomic context. Gold is a unique commodity as it serves both as a store of value and a safe haven asset. In terms of supply, gold is relatively scarce, with mining production being one of the primary sources. Factors like mining costs, exploration activities, and geopolitical stability in major gold-producing countries influence the supply of gold. Additionally, central bank sales and recycling of gold also impact the overall supply in the market.

On the demand side, gold is sought after for various purposes, including jewelry, investment, and industrial applications. Economic conditions, geopolitical tensions, inflation expectations, and currency movements are key drivers of gold demand. In times of economic uncertainty or market volatility, the demand for gold as a safe-haven asset tends to increase, leading to higher prices. Conversely, during periods of economic stability or when alternative investments offer higher returns, the demand for gold may decrease, putting downward pressure on prices.

The interplay between supply and demand dynamics shapes the equilibrium price of gold in the macroeconomic landscape. Fluctuations in either supply or demand can lead to price volatility in the gold market, making it a fascinating area of study for economists and investors alike.

Final Thoughts

In conclusion, the price of gold is influenced by a complex interplay of macroeconomic factors. From inflation and interest rates to currency movements and geopolitical uncertainty, a variety of variables can drive fluctuations in the price of this precious metal. By understanding these macroeconomic factors, investors can gain insights into what drives the price of gold and make more informed decisions when considering gold as part of their investment portfolio.

All Tags

Loading...

Loading...