Career Counselling and Guidance

Recession Coming? How you should be prepared?

Vandana Matta

September 06, 2022Preparing for a possible recession can help mitigate its impact on your financial well-being. Consider building an emergency fund, reducing debt, diversifying investments, and maintaining a stable income source. Additionally, staying informed about economic trends and seeking professional advice can equip you with the knowledge needed to navigate uncertain times.

What Is the Recession meaning?

A recession is a significant, widespread, and prolonged downturn in economic activity. Because recessions often last six months or more, one popular rule of thumb is that two consecutive quarters of decline in a country’s Gross Domestic Product (GDP) constitute a recession.

Recession coming?

India will be the fastest growing major economy this year and the next despite headwinds from rising inflation, widening trade deficit, and a declining rupee, a top government source said. Experts believe that there is no chance of India slipping into recession 2022. India is on a steady path of growth.

There is no second thought that growth will slow down, we will still be the fastest growing economy this year and next year,” another source said.

While the widening trade deficit and depleting forex reserves due to higher import bills had raised alarm bells for the current account deficit (CAD), the source said the situation should stabilize soon.

The source went on to say that the 7% decline in rupee value against the US dollar this year was not worrisome, and the government and RBI are confident in managing the situation.

Rise of Inflation

While inflation continues to be above the comfort zone, the economy has continued on its recovery path, supported by pent-up demand for services and higher industrial output. Major forecasters, including the RBI, have put the GDP growth estimates for the current fiscal at over 7%, higher than the growth rate of any major economy.

As per the source, the Rupee level is not worrisome; the government and RBI are monitoring the rupee movement continuously. There is no further measure on cards to encourage the inflow of dollars.

Regarding concerns of a balance of payments crisis, where India may not have enough forex to pay for imports, the source said since prices of crude oil and electronic items have come down, CAD should not pose a major challenge and it should stabilize soon. As per experts, CAD would balloon to 3% of GDP in the current fiscal from 1.2% last year.

Inflation has stayed above the upper tolerance limit of 6% for six straight months.

Even as international agencies like the World Bank and the International Monetary Fund (IMF) have downgraded growth rates of economies, each time India has remained the fastest-growing economy, as told by Sitharaman. A Bloomberg survey also recently said there is zero probability of India slipping into a recession.

Recession for India

According to the Bloomberg survey of economists, the probability of recession is zero for India. Inflation and a possible growth slowdown are primarily due to global shocks. The external headwinds having a bearing on the Indian economy could see moderation.

The International Monetary Fund (IMF) in its July update of the World Economic Outlook (WEO) has lowered India’s growth forecast for the current year by 80 basis points to 7.4%. The revised growth projection is closer to the official estimates and appears more realistic. For the next year, the IMF has projected India’s economy to grow by 6.1%. The revision in growth projections is attributed to less favorable external conditions and rapid policy tightening.

While global growth is projected at 3.2% for 2022, the IMF report has flagged concerns regarding an oncoming recession global (defined as 2 consecutive quarters of negative growth). This could be a concern for the US and other advanced economies. However, the probability of a recession in India seems to be low as of now.

Impact of Recession on Gems & Jewellery Industry

Artisans employed in gems and jewellery are now feeling the impact of the economic recession. Nearly 50,000 artisans have lost their jobs due to a decline in exports, claims Gems and Jewellery Export Promotion Council.

The vice-chairman of All India Gem and Jewellery Domestic Council says thousands of skilled artisans are staring at the prospects of losing jobs and the hike in customs duty and GST rate is affecting customer sentiment.

Recession in Jewelry Industry

The jewelry industry is witnessing a “recession” and skilled artisans are staring at the prospect of job losses, the All India Gem and Jewellery Domestic Council said on Monday.

In the Union Budget for 2019-20, customs duty on imported gold was raised from 10% to 12.5%, while GST on jewelry was fixed at 3% compared to 1% in the erstwhile VAT regime.

“The jewelry industry is passing through a recession due to low demand. Thousands of skilled artisans are staring at the prospects of losing jobs,” vice-chairman of the council, Shaankar Sen, said. He said the hike in customs duty and the present GST rate is affecting customer sentiment, as jewelry prices have increased.

In the Union Budget for 2019-20, customs duty on imported gold was raised from 10% to 12.5%, while GST on jewelry was fixed at three percent compared to one percent in the erstwhile VAT regime.

So far U.S. economic experts basically avoid calling the current situation a recession pointing to the fact that some indicators reflect growth as usual. However, in any case, there is a deep financial crisis on hand, which significantly affects business in the jewelry industry. The Future of Jewelry Industry looks great and high growth.

Currently, during the economic crisis inquiries about luxury items are being replaced with questions about more mundane and cheaper goods and services.

“For items like luxury goods, diamonds, queries are down more recently and there have been more queries for jobs, mortgages, and refinancing,” Marissa Mayer, Google VP of Search Products and User Experience told.

Consumer Spending in the US

Research firm Unity Marketing conducted its regular survey of luxury consumers – the first one since the bail-out on Wall Street. Based on this study, Unity Marketing predicts that these economic events will have a profound impact on the luxury market. “Few luxury brands are going to weather this global economic crisis with impunity,” says Pam Danziger, president of Unity Marketing.

The survey of consumers having an average income above $209,500 was held on October 3-8. “Our latest survey of 1,200 affluent consumers shows that the majority of affluents are changing their shopping behavior in response to the current economic climate. In particular, they are shopping less often and shopping more strategically by making lists. comparison shopping. They are doing their research before venturing into the stores. These new shopping patterns are going to put additional pressure on struggling retailers. They are who traditionally have looked to the upper-income shoppers to bolster their revenues,” Danziger said.

“Further luxury brands need to look at their product assortment and price ranges since affluents are widely choosing to buy fewer premium brands to save money,” she said. So a luxury brand that offers more accessibly priced alternatives can keep their customers from trading down to another brand.

Brand managers also need to ramp up their marketing to help justify the expense of paying a premium for their brands, Unity Marketing concluded. For today’s resistant affluent shoppers, luxury brands need to focus their marketing messages on the quality, value, and substance inherent in their brands, rather than on image or status. In other words, they need to sell the ‘steak’ again, not just the sizzle.

How should you be prepared?

Scale means growth

Throughout the earnings call, Drosos refers to scale frequently. It’s capitalizing on its scale at retail, with each of its banners now clearly differentiated thanks to the Brilliance plan.

Much of the credit for its banner differentiation has come through a significant investment in targeted marketing. This is including a $180 million increase in advertising in the past year. That enabled more targeted digital advertising and gave it a 50% share of voice in television.

In North America, average transaction value was up more than 15%, and in-store conversion was up nearly 20% compared to two years ago. It grew its number of new customers by nearly 1/3rd over fiscal 2021 and brought back 37% of customers who had lapsed more than two years.

And scale is enhanced through its enhanced data analytics capabilities. It has a fully integrated inventory management system across the entire company and the insights necessary to optimize its retail footprint. Over the last four years, it reduced its retail fleet by 20%. And thanks to its efforts to differentiate its banners, Kay and Zales stores can sit side-by-side and not cannibalize sales as they once did.

Deeper customer connections

Its digital e-commerce portal is leading to deeper levels of customer engagement. Approximately 65% of customers start their customer journey digitally. And some 90% of its high-value customers, who spend more than $500, engage across its different shopping channels.

Most customer transactions are completed in-store – 80% versus 20% via e-commerce. Drosos explained that the strategic importance of its digital platform is measured in more than just sales.

Giving customers more of what they need

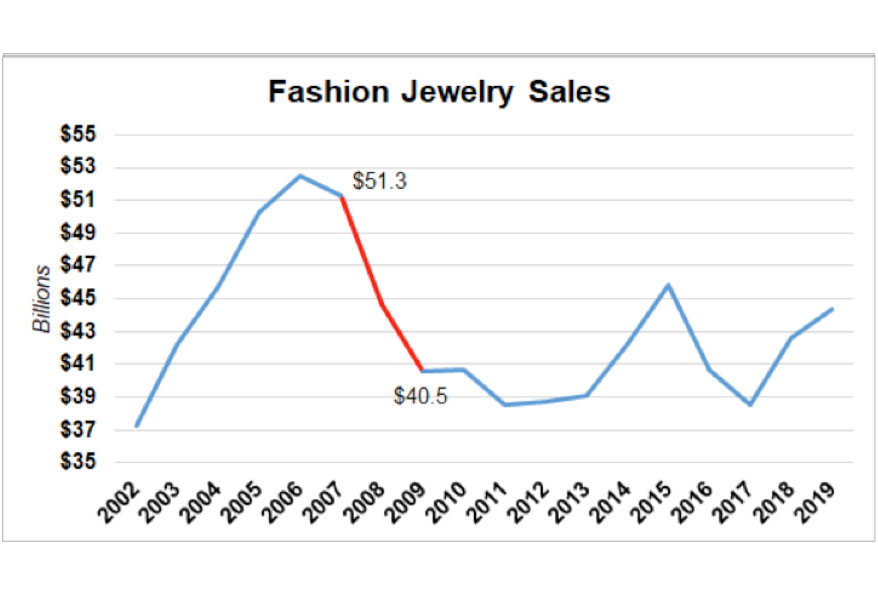

When times get tough, discretionary purchases, like jewelry, are the first place that consumers cut. During the recession 2008/2009, spending on jewelry dropped 14% from its 2007 high to its 2009 low. This year will be a boom time for the wedding business. Some 2.5 million weddings will take place in 2022, more than seen since 1984. It is up 16% since 2019, according to the Wedding Report.

And attending weddings yields a compounding effect on future wedding statistics. Dating couples who attend a wedding are the most likely to get engaged shortly afterward. So more weddings mean more new couples getting married and more bridal jewelry sales down the road.

Besides bridal, Signet is also leaning into more jewelry repair and extended service agreements. To make this a $1 billion business, Signet grew services revenues to $620 million in fiscal 2022, up 65% year-over-year. And repairs are offered for all jewelry no matter where it is purchased.

Conclusion

Preparing for a recession involves several key steps. Firstly, build an emergency fund to cover at least 3-6 months of living expenses. Secondly, reduce debt and avoid unnecessary expenses. Thirdly, diversify your income sources and invest wisely. Lastly, stay informed about economic trends and seek professional advice if needed.

All Tags

Loading...

Loading...